2023 Recap : 5 Belgian purchase insights from a supermarket sector grappling with price pressure

2023 was another year defined by pricing pressure felt by competing chains looking to gain ground in the Belgian market, where customers struggle with a cost of living crisis.

Much like the year prior, a heavy promotional push based on price has been the strategy for chains like Colruyt, Lidl, and Aldi, who fight to offer the lowest price. Below, we look at five purchase insights that show how players in the supermarket sector fared in 2023 and look closer at the fight to provide lower prices.

5 purchase insights from 2023

⭐ Market share - Colruyt remains the biggest player in the Belgian supermarket industry. The leading chain in Belgium, accounting for nearly a third of the market on its own without including Okay and Spar, continues to maintain the lead firmly in the market. Despite its insistence on offering the lowest price guaranteed, the top half of 2023 saw Colruyt increase prices along with its competitors, according to insight from Retail Detail. However, the article also highlights the pressure the chain is feeling from competitors aggressively competing on price, in December, Mars and Unilever products were missing from shelves for that very reason.

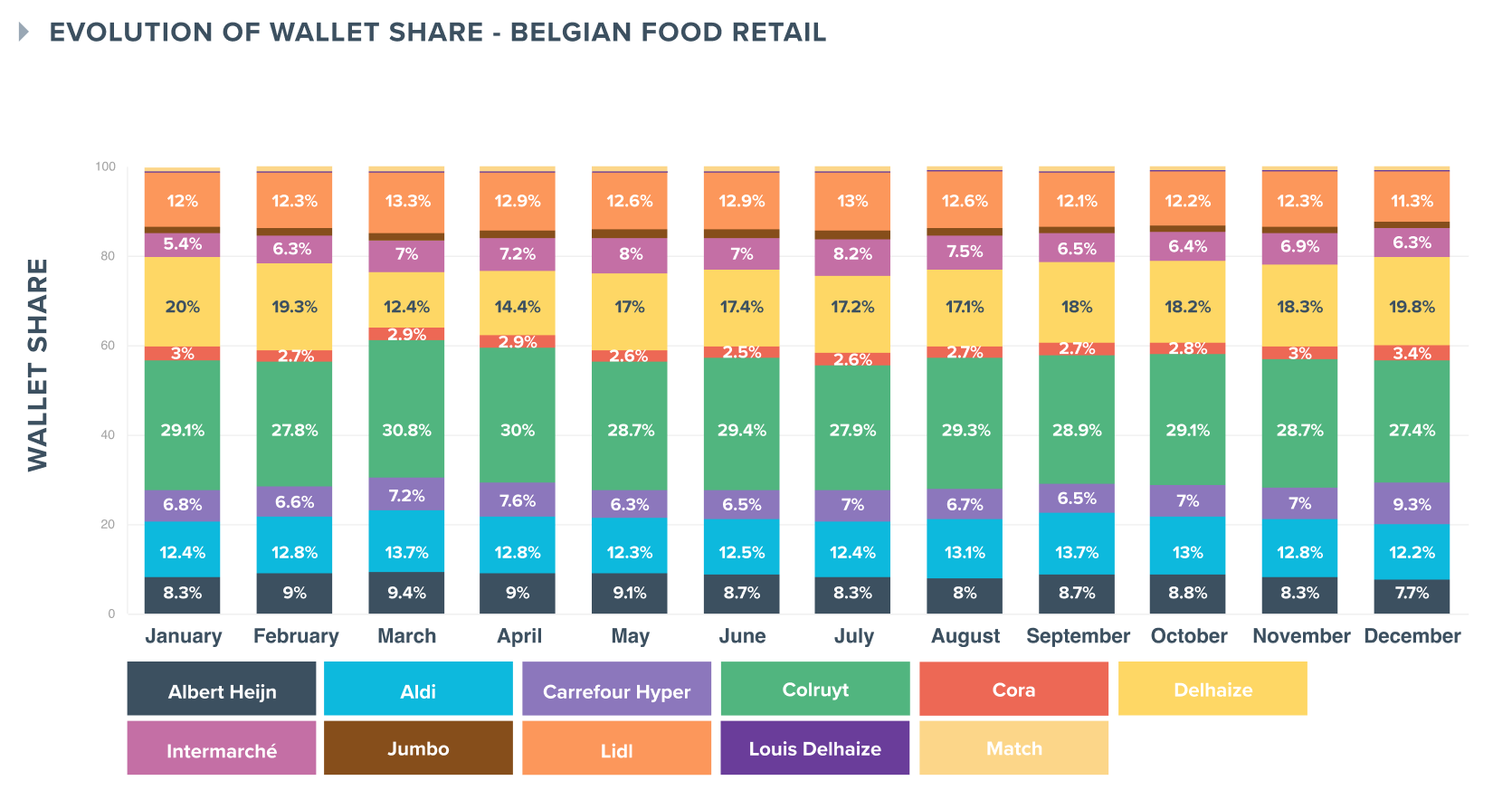

⭐ Share of wallet - Carrefour, who deployed its own price-based strategy, which saw the brand freeze prices in certain items, saw the most significant shift in their share of wallet in 2023. The French grocery giant saw a 2.5-point increase in December compared to January. However, it's important to mention that hypermarkets, such as Carrefour's, see an uptick in spending at the end of the year during the holiday season; it will be interesting to see how they maintain wallet share in Q1 2024. The leading chain, Colruyt, saw a 1.7-point drop in 2023, ending the year on a low with 27.4% of consumer wallet share.

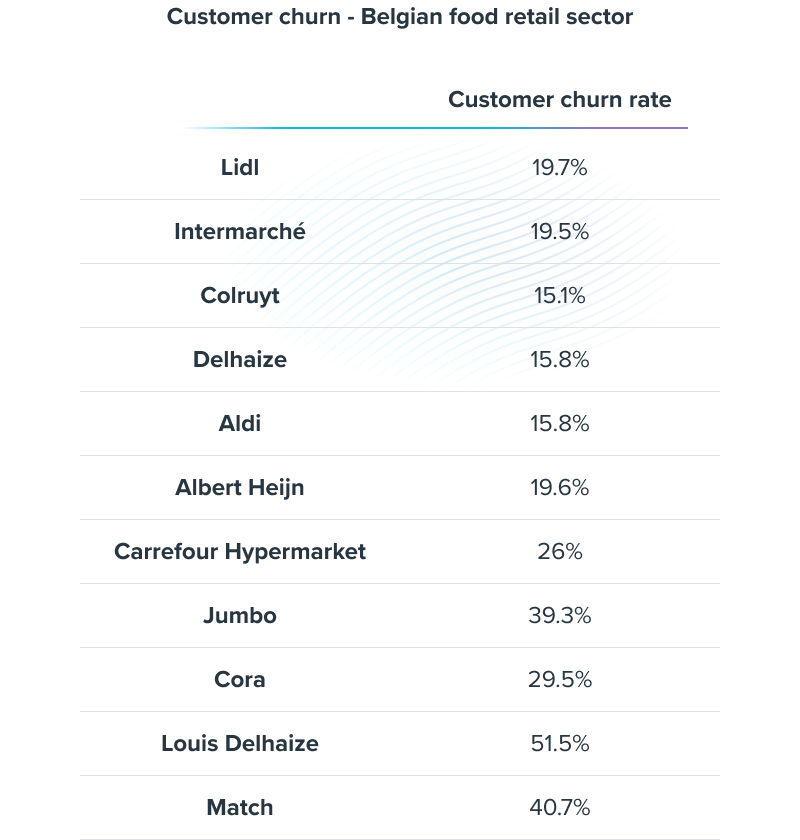

⭐ Customer churn - Louis Delhaize has a substantial churn issue, with 51.5% of customers who purchased in the first half of the year not making a purchase in the second half. Colruyt maintained the lowest churn rate, with only 15% of customers from the first half of the year not making a purchase in the last 6 months of 2023. Delhaize and Aldi came in close behind with a churn rate of 16%.

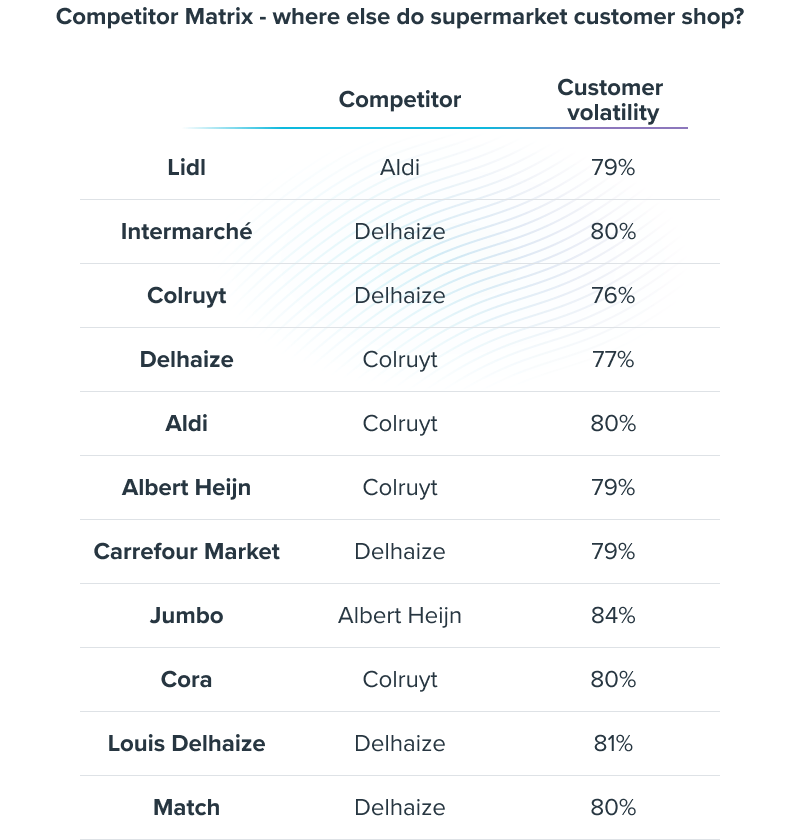

⭐ Which competitors do customers frequent most - Delhaize serves as the main alternative for 5 of the top 11 chains in Belgium (Intermarché, Colruyt, Carrefour Hyper, Louis Delhaize, Match), and Colruyt was the primary alternative for customers of 4 other chains (Delhaize, Aldi, Albert Heijn, Cora).

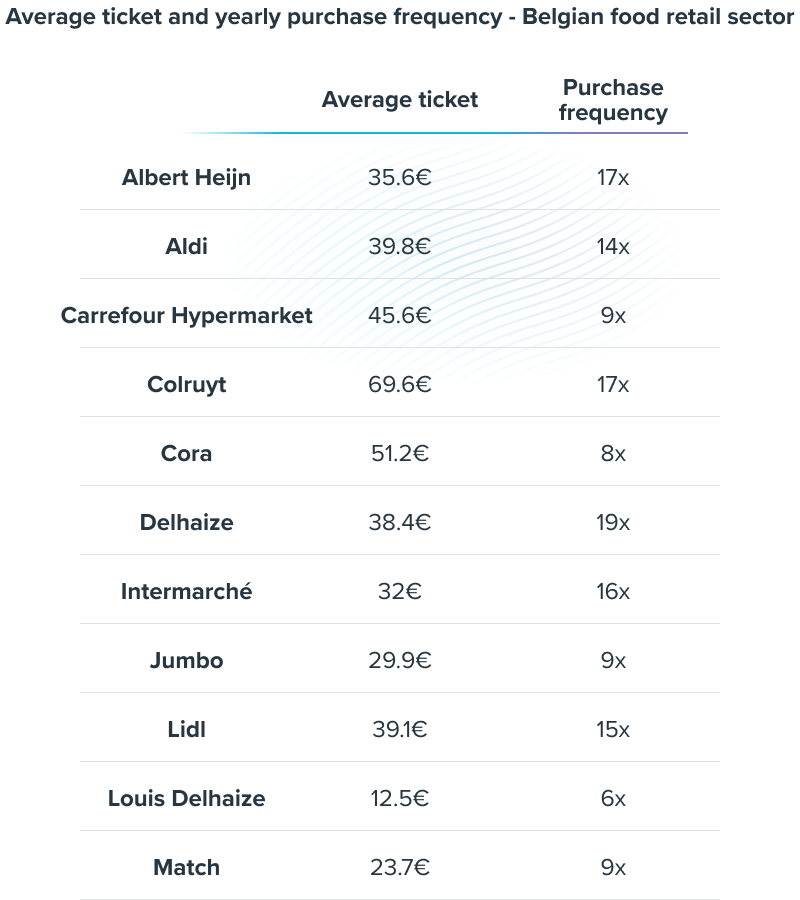

⭐ Average ticket - Colruyt customers spend more on average per visit than customers of any other supermarket (69.6€). The next closest average ticket was at Cora, where customers spent 51.27€ on average.

⭐ Purchase frequency - Delhaize purchased most frequently, with the average client making 19 trips a year. The next closest brand was Albert Heijn, whose customers purchased on average 17x throughout 2023. Conversely, Louis Delhaize saw the fewest visits on average throughout the year.

📉 Brand strength will continue to decline as chains continue to compete on price

An eye-opening perspective from WPP's Brand Study 2023, highlighted the effects of a substantial shift to price promotion and discounts that characterized the marketing strategies of Belgian supermarkets aiming to bring in consumers grappling with inflation in 2023. Basing strategies solely on promotion and price may have made customers equate brand value heavily on price and prioritize the retail experience, customer service, and quality less. Theoretically, this should have seen Belgians favor brands such as Lidl, Aldi. However, while Lidl maintained its brand differentiation strength based on WPP's BAV (Brand Asset Valuator measurement tool), Aldi saw an unexpected dip alongside all the other brands in the supermarket sector. Read the full report from Retail Detail here.

Our take

As seen above, competing based on price doesn't always bring in the goods, or in this case, customers. Relying on providing the lowest price cuts at margins and may erode the brand's perceived value in the long term. Our data shows that while Lidl managed to prize more wallet share from customers in March through to July, they ended the year with less wallet share (-0.7 pts). Aldi also saw slight increases in wallet share throughout the year, most notably in March (+1.3 pts) and September (+1.3 pts), but still ended the year with 0.2 points less wallet share than they started it with. Conversely, Carrefour, who isn't as aggressive on price promotion, ended the year with +2.5 pts more wallet share.

Lidl’s recently published financial results show the effects of competing mainly on price. While sales grew for the German grocery giant, profitability dipped to its lowest level since 2012. Lidl’s decision to not pass on all costs to customers to stay competitive is certainly reflected in the bottom line.