Belgian Black Friday Sales Results 2023

With another Black Friday sales event behind us, we take a closer look at the impact it’s had on the e-commerce and consumer electronics sectors in Belgium to see who ended the week long sales event on a high. This study includes sales insights from the following brands in the e-commerce and consumer electronics sectors; Amazon, Apple, Bol, Cool Blue, Fnac, Krefel, Media Markt, La Redoute, Vanden Borre, Veepee, and Zalando.

This year’s edition of Black Friday saw 20% of the sectors customers since January 2023 make a purchase, and only 33% of clients who made a purchase in 2022 participate in this year. Moreover, 80% of the clients that didn’t make a Black Friday purchase in 2022 weren’t tempted in 2023 either. This may be a sign of sales fatigue and consumer doubt of the deals on offer.

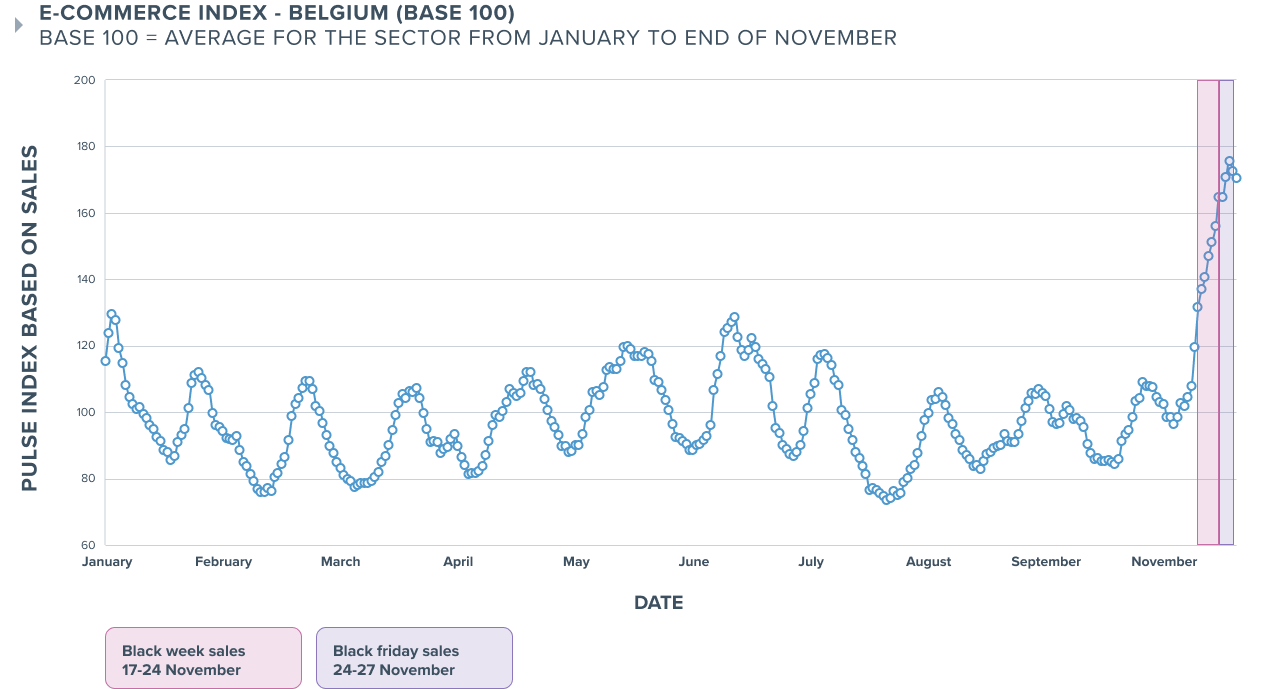

However, looking at our index tracking sales among the brands in the study, we still see a strong increase in sales during the period which reached its peak on the 27th of November when daily total sales value (7 days rolling average) was 76% higher than the daily average in 2023 thus far.

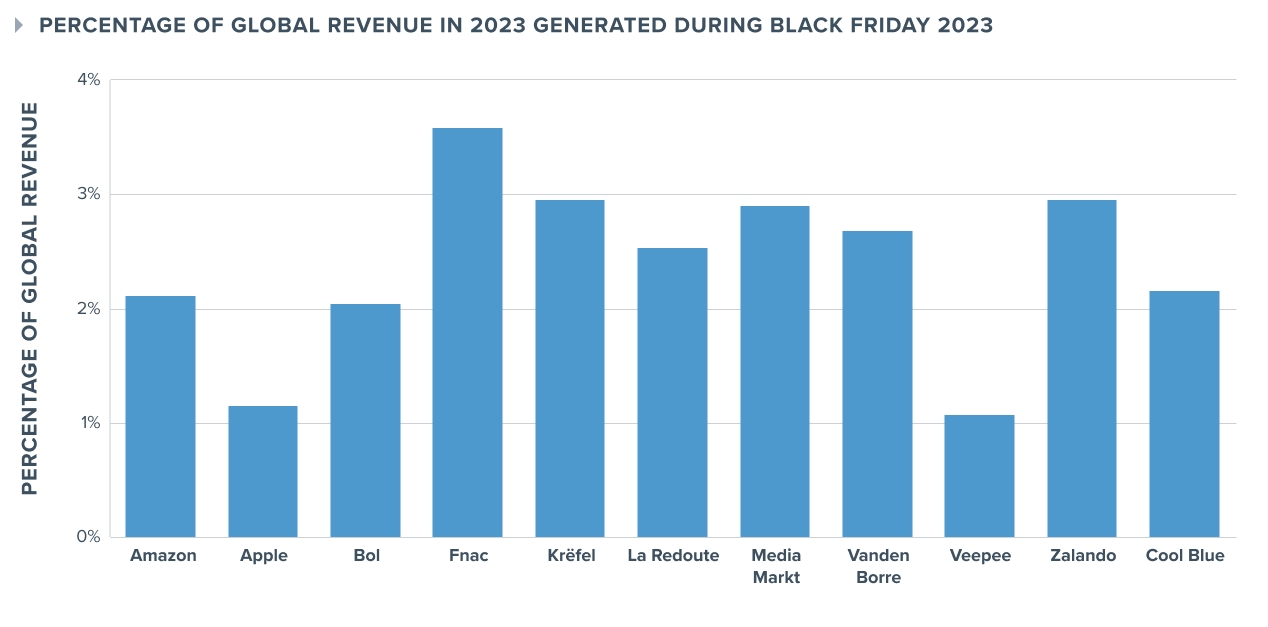

At the brand level Amazon and Bol accounted for over 50% of the sales during Black Friday, as is the case among the brands studied throughout 2023. In third place during the sales period we find Zalando who sits in the fourth spot when looking at total sales across 2023. In terms of overall revenue on the year, Black Friday accounts for anywhere from 1% to 3.5% of total sales for the brands included in the study.

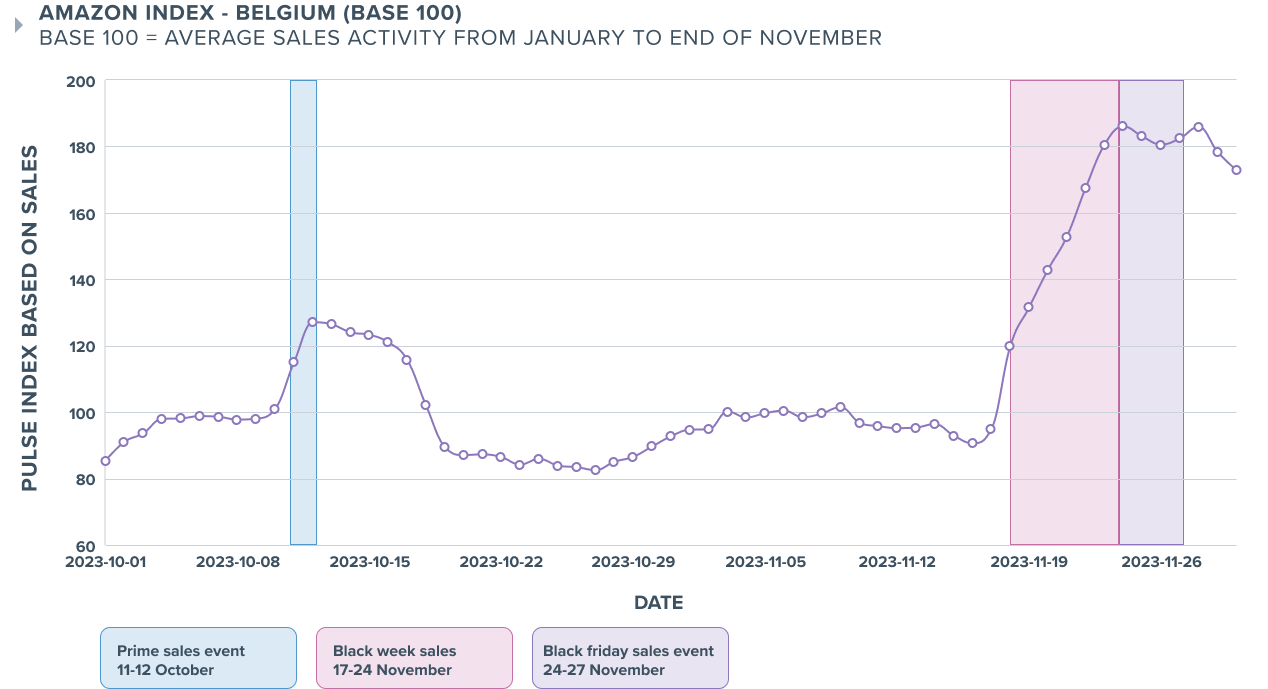

Amazon, who held their twice a year Prime days sale, saw a significant increase in sales during Black friday compared to their autumn sales event. The proximity of both sales clearly did not have a cannabalizing effect on sales and gave customers another opportunity to save on holiday shopping.

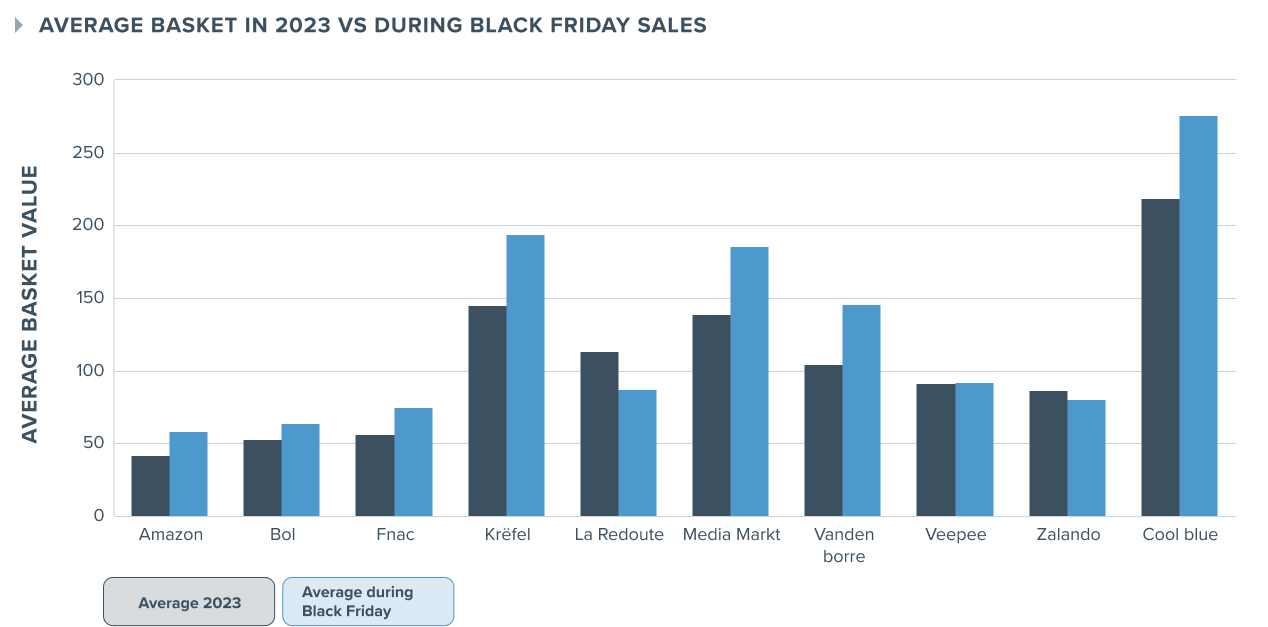

Average baskets also saw an expected rise compared to the rest of 2023 with Amazon (+41%), Vanden Borre (+39%) and Media Market (+34%) showing the strongest increases. However, purchase frequency was not particualrly high as clients made 1.42 purchases on average, with only 27% of clients making two purchases our more.

What stands out from this year’s sale?

Client’s may becoming apathetic to Black Friday promotions as only 20% of the sectors customers made a purchase during the week long event. We will be sure to track next years event to see if the percentage of repeat sales participants which stood at 33% this year, decreases further in 2024. There is also the behaviour of customers that don’t participate in the event that will be key to monitor, will the percentage of clients that didn’t make a Black Friday purchase in 2023 still decide not to purchase in 2024?

Want the full report? More than 100 leading retailers use PayLead to get more payment insights on customers and competitors, create great customer experiences, and grow their businesses. Schedule a call