Fashion in Spain : Shein is coming for the e-commerce crown, while Inditex corners the retail market

Looking closer at online and retail purchases, this study focuses on highlighting the divide between both channels and shows which brands flex their omnichannel muscle most, as well as the marked seasonality that characterizes the sector.

On the e-commerce side of the market Zara reigns supreme presently but Shein is making waves in the industry. Retail sales are also dominated by Zara and Inditex as a group who also counts Pull&Bear Bershka and Stradivarius among its brands.

Inditex is in the clear

Zara’s retail business remains far and above the leader of the highly fragmented fashion market in Spain with 23 percent of market share, and is followed by its online business (11,3%), giving the brand just over a third of the entire market. Primark comes in a far second position accounting for 10.5% of the market and in third place the Chinese e-commerce giant Shein managed to bring in 10% of sales in the last year.

*Other online sites include: Lefties, Pull & Bear, Stradivarius, Bershka, and H&M online

Focusing only on Zara’s division of online versus in-store purchases we see that roughly 33% of all purchases in the last year were made online, which remains far above the 21% of online sales seen in Spain in 2021.

Looking at Inditex as a group, one can envision the stranglehold the Spanish behemoth has on the market. Among the brands analyzed in the study, which includes Bershka, H&M, Lefties, Mango, Pull and Bear, Stradivarius, Vinted, Zalando and Zara, Inditex holds 56% of the entire Spanish market.

Shein is coming for the e-commerce crown

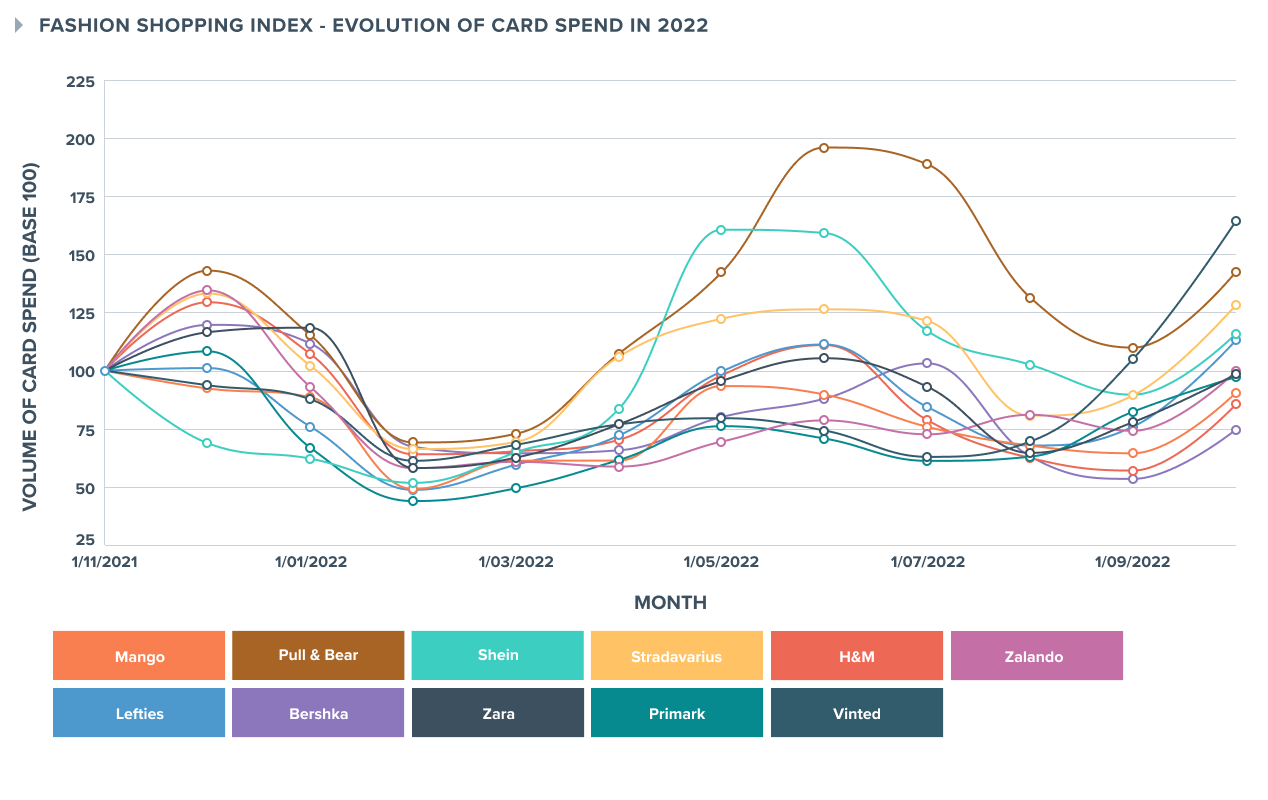

Closely behind Primark in market share in our study is Shein, the pure player has amassed roughly 10% of the Spanish market as well and is only behind Zara in terms of online sales. Throughout 2022 Shein has experienced a substantial increase in its market share of online purchases. While the brand experienced a dip in January it saw an incredible rise leading to a peak in May when they brought in nearly 35% of online fashion sales. Twice throughout the year in April and September, Shein and Zara have traded places for the most online sales. This heated rivalry will continue to rage on as Shein continues to gain ground on Zara’s home turf. Currently Shein remains a pure player, but has flirted with the retail space after launching pop-up stores in Madrid and Barcelona in June and most recently November 2022.

The real-time fashion brand, who is cornering the fast and affordable corner of the online market, also maintained a considerably high average ticket size throughout the year, with the average never falling below 40 € and reaching as high as 55 € in the months of November (2021) and May. Given the low pricing of Shein products, it's surprising to see it round out the top five brands with the highest average tickets throughout the year. This is also surely boosted by the free shipping offers that come with spending a certain amount. However, currently free shipping to a delivery point is set at 29,00€ on the Shein website, which falls well below the average they’ve brought in through 2022.

Vinted drives the second-hand trend

The second hand trend is largely dominated by Vinted and the success of the Lithuanian brand has placed it directly into the top fashion sites in Spain. Looking at our index we can see that the Vinted started the year on the wrong foot with the brand not seeing the same amount of card spend seen in January until September. However, in October Vinted witnessed an impressive 59% increase in activity.

Sales and volatility come and go with the seasons

Vinted saw the biggest jump in activity from September to October, but was not an anomaly among the fashion industry. Fashion is highly affected by seasonality and sees its biggest peak in the summer months from May to July, then goes through a fall slump which leads to a pickup in sales from October to December.

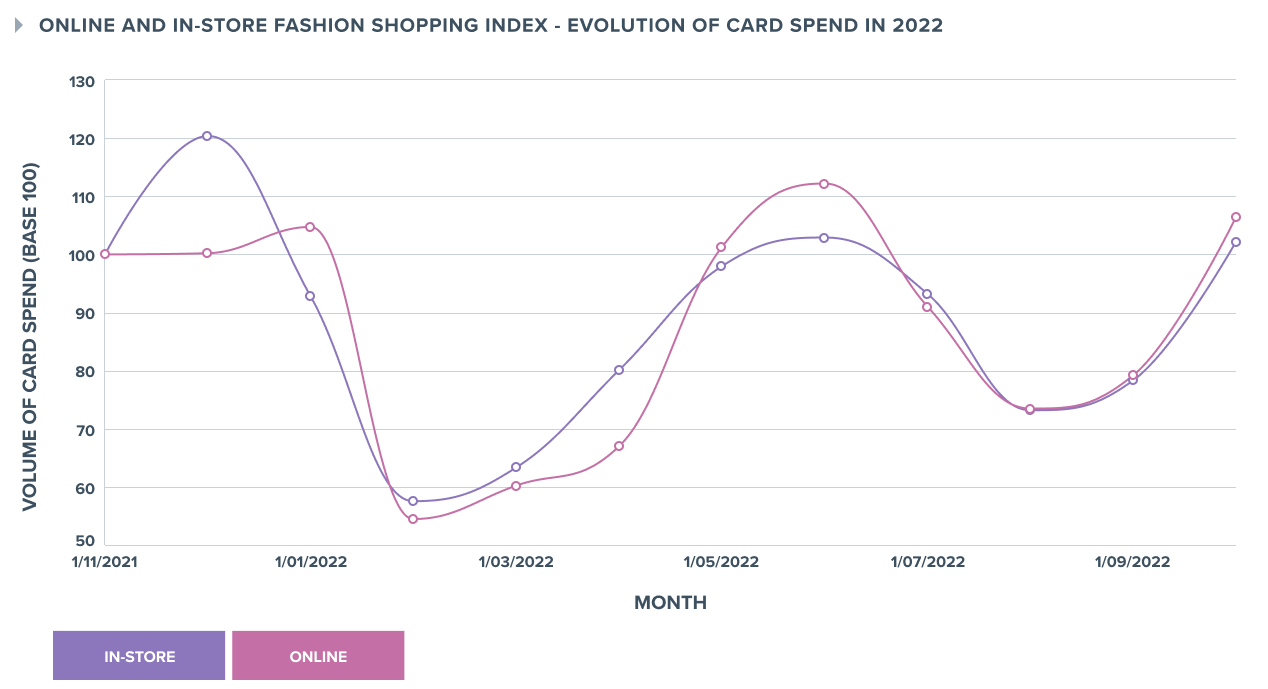

The trend is visible across online and in-store sales, with both channels seeing the same seasonal peaks throughout the year. The only slight difference is seen in December, most likely due to clients making their Christmas shopping rounds in boutiques.

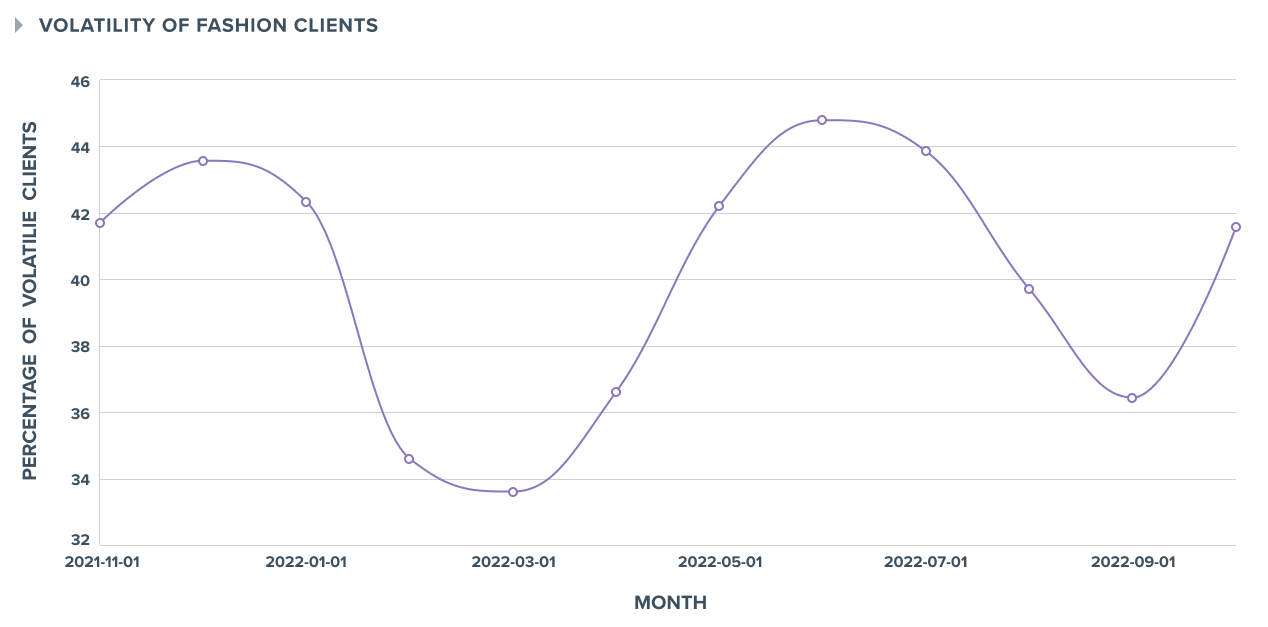

The volatility levels of clients, meaning the percentage of clients who visited two more stores in the last 12 months also saw increases during the same winter and summer months. This may be largely tied to summer and winter sales when clients are looking for the best deals rather than shopping at their favorite stores.