Home improvement retail in Spain: a sector struggling with churn

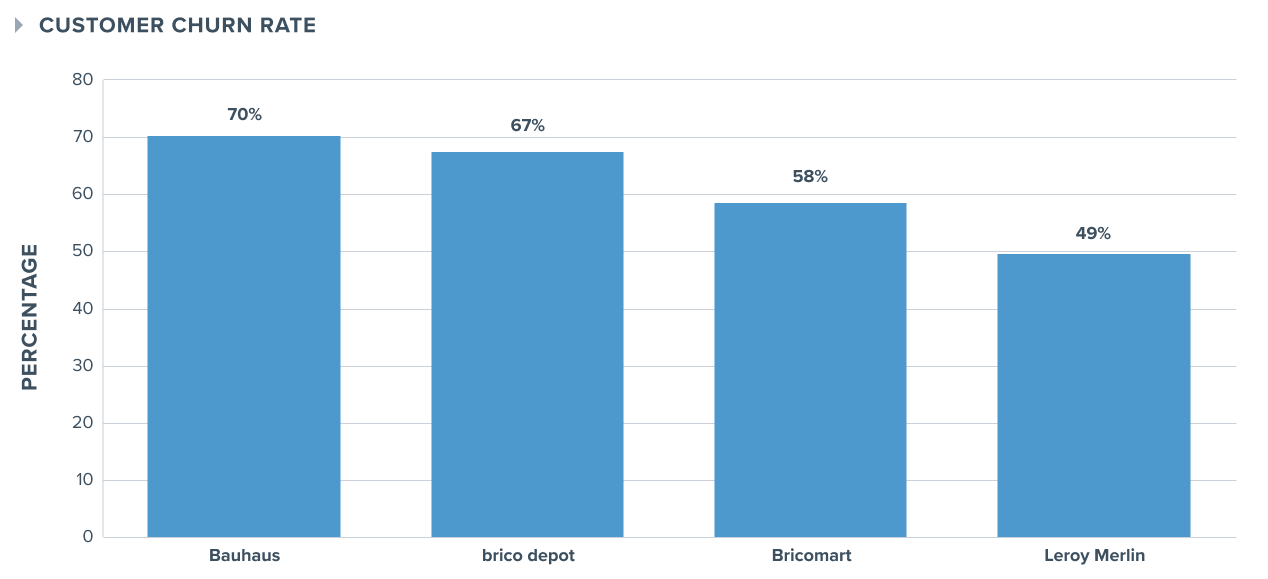

What is churn? We define it as the percentage of customers of a brand or sector that purchased during one quarter but not the next. High churn levels could be expected for the highly seasonal home improvement industry, but the numbers show a staggering drop for certain brands.

Looking at customer churn from a brand level, we can see that Bauhaus and Brico Dépôt, are most affected by churn, with 70% and 67% of their Q1 clients not purchasing in the second quarter of 2022. Leaders in the market, Leroy Merlin, aren’t spared from the trend either. On average, six out of ten Bricomart customers and half of Leroy Merlin clients who made a purchase in Q1 didn’t follow up with a purchase in Q2.

Globally the industry saw nearly half of their clients (46%) who purchased in Q1 not purchase Q2 of 2022.

A seasonal sector driven by spring and summer spending

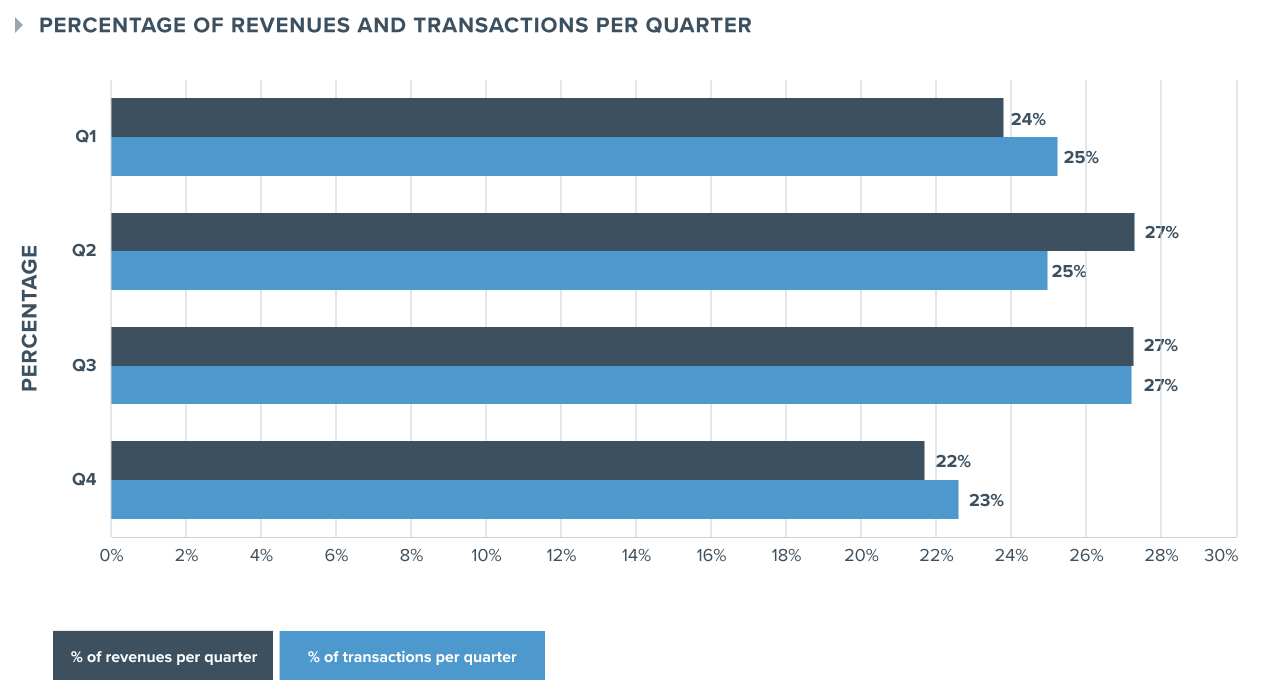

On average, the Spanish spent €18.34 per month (€220 in 2022), with a sparse purchase frequency of only roughly 4 (3.95) times in the year. This meant the average basket across the home improvement industry hit €56. Large averages, baskets, and infrequent purchases are all very characteristic of a seasonal industry that sells a variety of necessities on a large price spectrum. Spring and summer, the key periods for the industry, saw its highest average basket in May at €65 and the highest number of transactions taking place in Q2 and Q3, which accounted for 27% of all transactions on the year. It’s important to note that while Q2 brought in 27% of the revenues generated in 2022, it only accounted for 25% of all transactions. This may be in part do to the type of products consumers are purchasing in Spring, which is typically a season consumer's privilege for moving and starting renovations, thus are purchasing higher ticket items.

The outright leader continues to make its mark

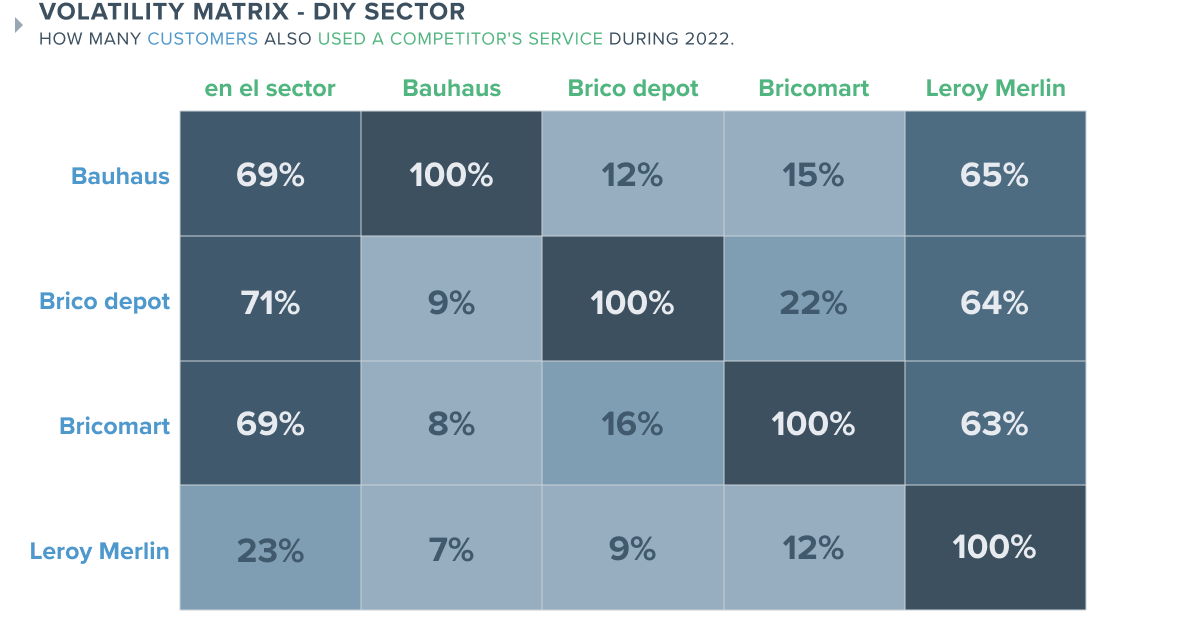

Another common fact of the industry is the outright dominance of Leroy Merlin. Almost 9 out of 10 (87% of the sector's customers) unique home improvement clients made at least one purchase with the French giant last year. Comparatively, the next biggest chain, Bricomart, only managed to bring in roughly 2 out of every 10 customers in the sector. The leading chain also works its magic in attracting the customers of its competitors. When looking at volatility across the sector, roughly 6 out of ten Bauhaus, Brico Depot, and Bricomart clients made a purchase at the Leroy Merlin. In contrast, its biggest competitor, Bricomart only saw 12% of Leroy Merlin customers purchase at their stores. Across the sector, only 23% of Leroy Merlin clients purchased at another Home Improvement retailer.

Where do the top consumers shop most?

It’s not all rosy for Leroy Merlin, who falls short in the minds of the sector's most valuable clients. By looking at the top 30% of spenders in the industry and cross-referencing them with the top 30% of clients who made the most purchases, we can see they only make up 13% of Leroy Merlin’s customer base. In contrast, these top clients represent 20-22% of the top of customers at Bauhaus, Brico Depot, and Bricomart.

The leader sees a fall in revenues

When comparing revenues generated by quarter, Leroy Merlin witnessed the biggest drop in the industry, losing 3.5 points from Q1 to Q4. They also saw the second-biggest fall in the percentage of transactions in the sector, with a slight dip of 1 percentage point. However, Bricomart, conversely, saw their revenues and percentage of transactions increase across the same period by 1.5 and 1.4 points, respectively.