How e-retailers are fighting to win online shoppers’ hearts

Who are today's online shoppers, and how do they select their favorite brands?

At PayLead, we constantly analyze large volumes of banking data to help banks rethink and improve their relationships with their customers. This transactional information is tremendously valuable, as it helps us draw a realistic picture of our economy, in real time.

A few weeks ago, we spotted unexpected patterns in the evolution of French online retailers' market shares. Among the main players (Amazon.com, Fnac.com, Cdiscount, Rakuten and Aliexpress), Chinese merchant Aliexpress seemed to be standing out and gaining significant ground over its competitors.

So, we decided to take a closer look at the battle that is currently raging between the French leaders of the e-commerce sector. To do so, we analyzed the transactional data of several thousand anonymous customers over 2019*. Here are the results:

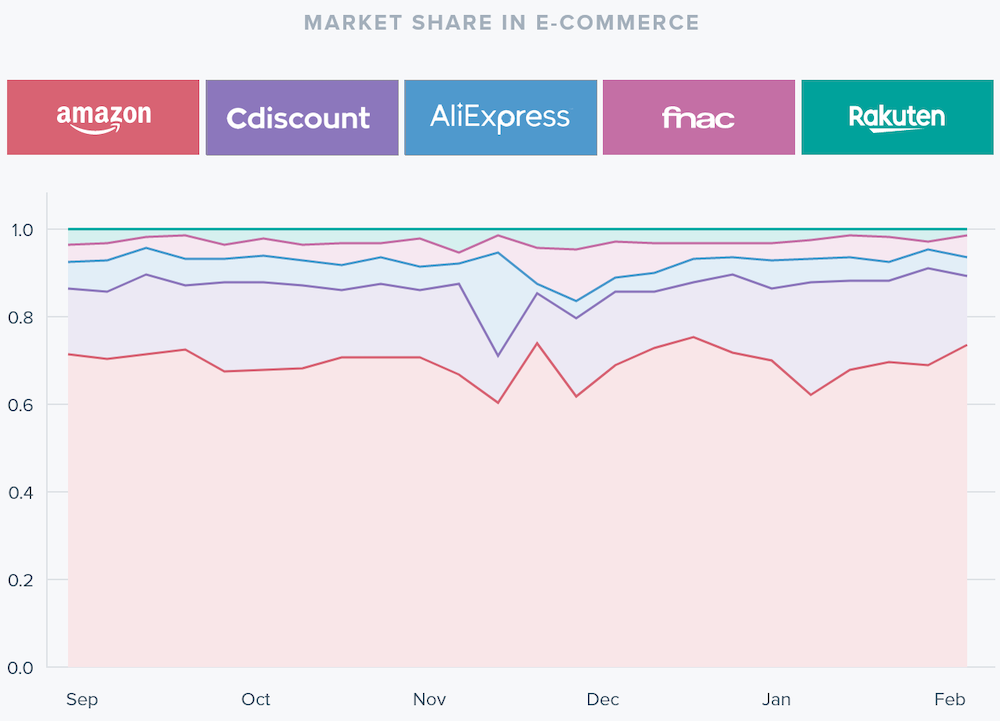

The war for market share is highly seasonal.

The graph above, which represents the evolution over six months of the relative market shares of the five online retail giants aforementioned, clearly shows that Amazon remains the undisputed leader in France, honing over 65% of the market's transactions (in terms of worth).

However, it is interesting to take note of the sales peak achieved by Aliexpress around mid-November, gaining nearly 20 incremental market share points, at the expense of the other players! This prowess correlates with Singles' Day (on November 11th), a marketing operation imagined by Jack Ma, founder of Chinese behemoth Alibaba, which celebrates celibacy by offering large discounts on its products. However, this performance remains surprising in France, as Singles' Day is not as popular in Europe as it is in China.

Singles' Day is quickly followed by a rapid takeover of Amazon, which recovers (and even goes beyond) its lost market shares, at the end of November. Unsurprisingly, this performance corresponds to a promotional operation of the same magnitude as Singles' Day, on which Amazon invests heavily: Black Friday (the Friday after Thanksgiving), during which the e-commerce giant registers a 15% jump of additional market share.

Promotional ops therefore remain a powerful lever to encourage online shopping, and it seems that special day-long operations from the United States (Black Friday) and China (Singles' Day) are starting to become an integral part of French consumer culture.

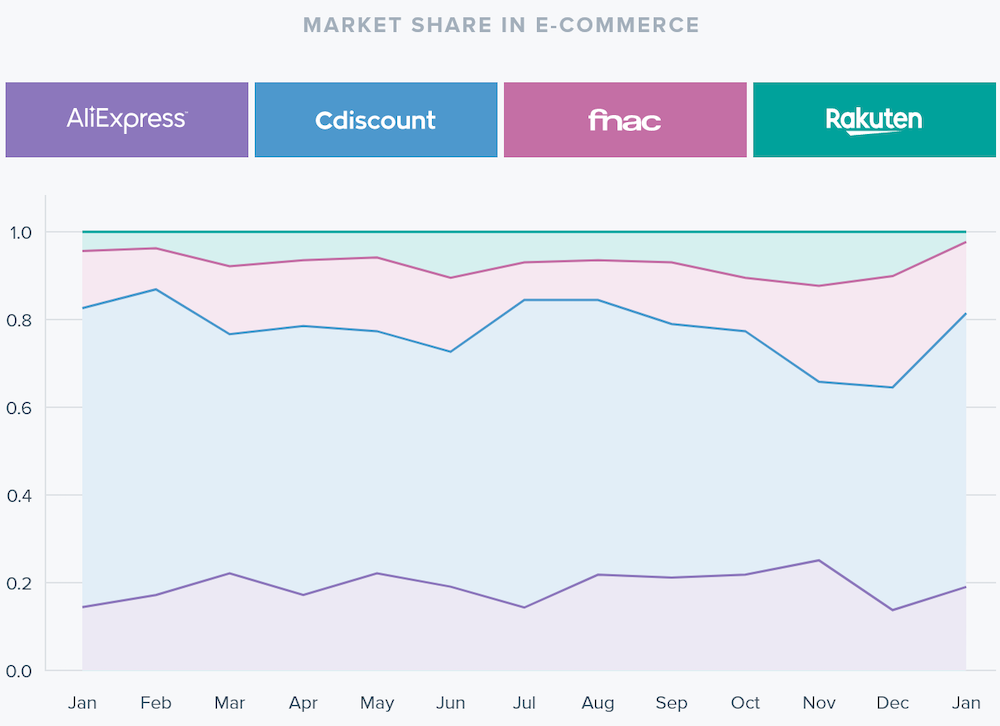

Whenever taking Amazon out of the equation, it is also interesting to see how two challengers are standing out from their competitors:

- Fnac.com achieves significant growth around the Christmas season period (+78% compared to its average market share over the year)

- Cdiscount is the undeniable winner of the summer holidays and the back-to-school period (+16% compared to its average market share over the year).

The battle to win the hearts of online shoppers is in full swing, with no real winner emerging at the moment, even if CDiscount seems to be performing well, and Rakuten looks like it is losing some of its ground. But who are their customers, and how/what do they buy from the different brands?

Who are the customers of France's online retailers?

Aliexpress customers are e-commerce aficionados

We studied the purchasing behaviour of consumers who had made one or more purchases from online retailer Aliexpress, and compared them to a control group made of various profiles**. We found that Aliexpress customers had a strong appetite for online shopping. Indeed, their monthly online spending is 20% higher (in value) than that of the control group! Even more strikingly, their monthly spending on Amazon.com is 34% higher (also in value) than the control group's.

A peri-urban shopper profile

Aliexpress customers display buying behaviours that suggest they belong to peri-urban communities:

- the amount they spend each month in their private vehicle is 26% higher than that of the control group.

- their monthly expenditure on public transport is 36% lower than that of the control group, revealing a very low use of public transport

- their monthly DIY/gardening expenses are 9% higher than the control group's, indicating a peri-urban dwelling.

- their median monthly income is 8% lower than that of the control group.

Low-cost enthusiasts

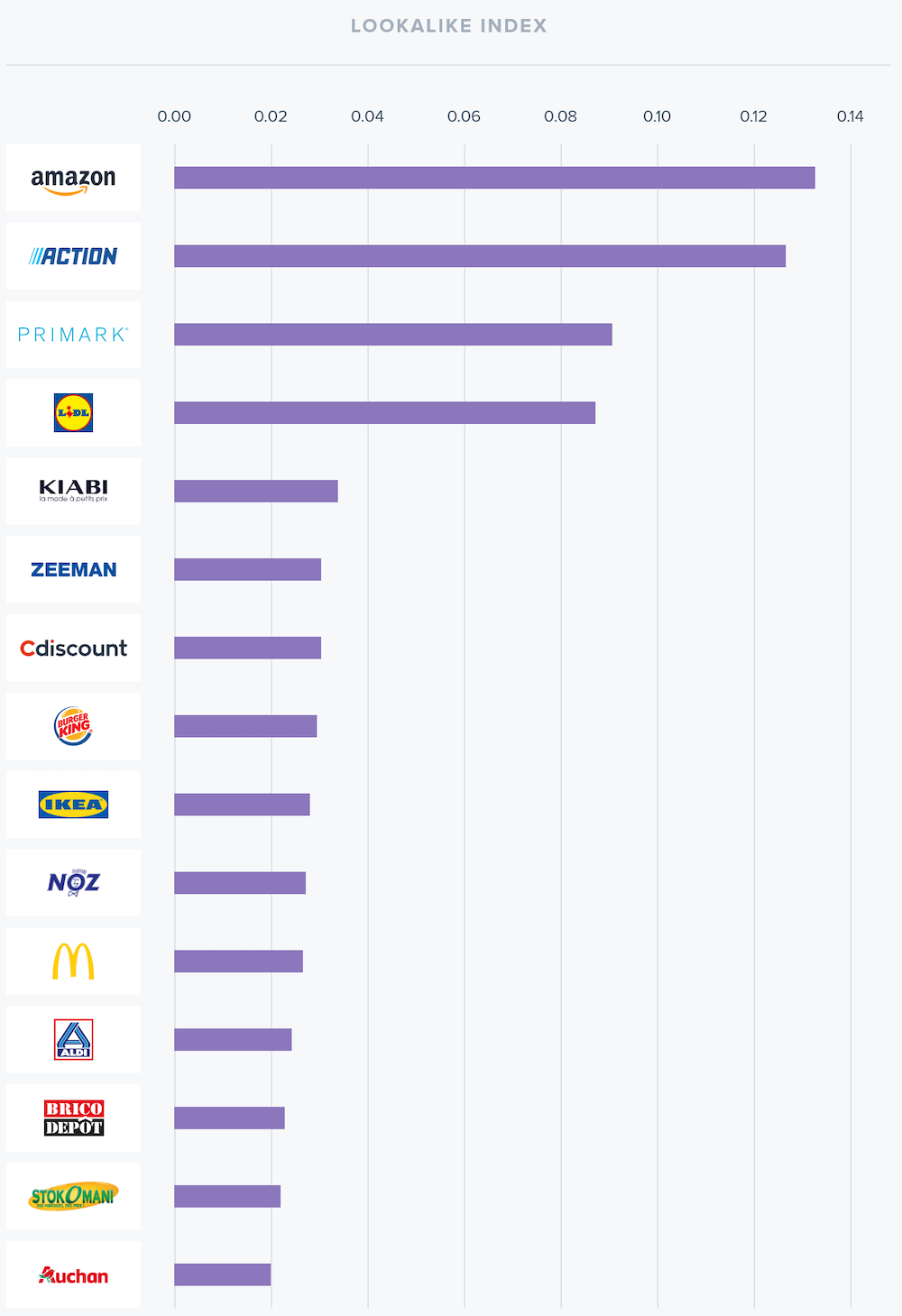

In the above chart, we indexed the brands that most characterize Aliexpress customers compared to the control group. These are : Action, Primark, Lidl, Kiabi, Zeeman, McDonald's, Burger King, and Stokomani. These are all well-known for their low-cost positioning in the mass retail market.

It also seems that online shopping remains highly correlated with everyday objects, and that discounts and promoted sales still have a bright future ahead of them!

Loyal shoppers

To better understand the behavior of e-commerce fans, we looked at customers who bought from at least one of the following online retailers: Cdiscount, Aliexpress, Fnac.com, and Rakuten (Amazon has been removed from this part of the analysis on purpose, to allow more granularity in the challengers' results).

It turns out that 5 out of 10 Aliexpress customers buy exclusively from the brand, and remain loyal to it. Furthermore, this trend does not only apply to Aliexpress. In the same way, 6 out of 10 Cdiscount customers buy exclusively from Cdiscount.

Who said online shoppers aren't loyal to their favourite brands?

* Data collected between January 2019 and February 2020 from 100,000 anonymous customers who conducted at least one transaction with their credit card.