Open banking is changing the face of loyalty programs

Despite attempts from banks to implement profitable and engaging reward programs, the lack of value generated for banks, merchants and a streamlined experience for end-users halted past efforts. Open banking is now changing the fortunes of reward programs.

In the past, cashback and loyalty programs had disjointed rewards experiences and required users to activate offers, which made it difficult to provide a seamless user experience and communicate effectively with consumers. As a result, users were often dissatisfied and engagement was low, with many programs seeing single-digit opt-in and activation rates.

Today, the paradigm has shifted with new technology and access to payment data. Rewards have become personalized, automatic, respectful of privacy, and so much more. The experience has changed, and so has the goal for banks and money apps. Not only do bank clients receive cash rewards, but the banks themselves receive a new stream of revenue from the data that was sitting idle before the right technology came to unlock this precious resource.

Making rewards automatic is the key to fluid user experiences

A key element lacking in past programs was a frictionless experience that made rewards convenient rather than a chore to earn. Making the program a central focus in daily banking apps alongside accounts and transaction history also helps drive engagement by making rewards top of mind. Users are, in most cases, unwilling to follow links leading to websites outside their banking app to browse offers or activate rewards in hopes of receiving rewards promptly, rather than the 190-day average wait in the affiliation industry. Poor user experiences, compounded with poor communications that didn't adequately generate visibility for reward offers, left some bank reward programs in Spain with only a 4% opt-in rate.

The cookie-based system for attributing rewards led users astray and hindered usage. Cookies forced users to activate offers and accept their use before being led to online purchase journeys that added more steps to the process rather than optimizing it. Despite using cookies, the experience also sorely missed the element of personalization.

However, the system has evolved into the personalized automatic rewards experience consumers have always wanted. Account and card-linked offer technologies (ALO) attribute cash rewards to purchases without clients needing to activate offers. This technology disregards cookies in favor of using purchase data, giving both banks and retailers the ability to provide clients with the ideal rewards experience free of past frustrations. This tech also places the users' privacy front and center and requires that they consent to use their purchase history, which is subsequently pseudonymized so that data can't be traced back to a single user.

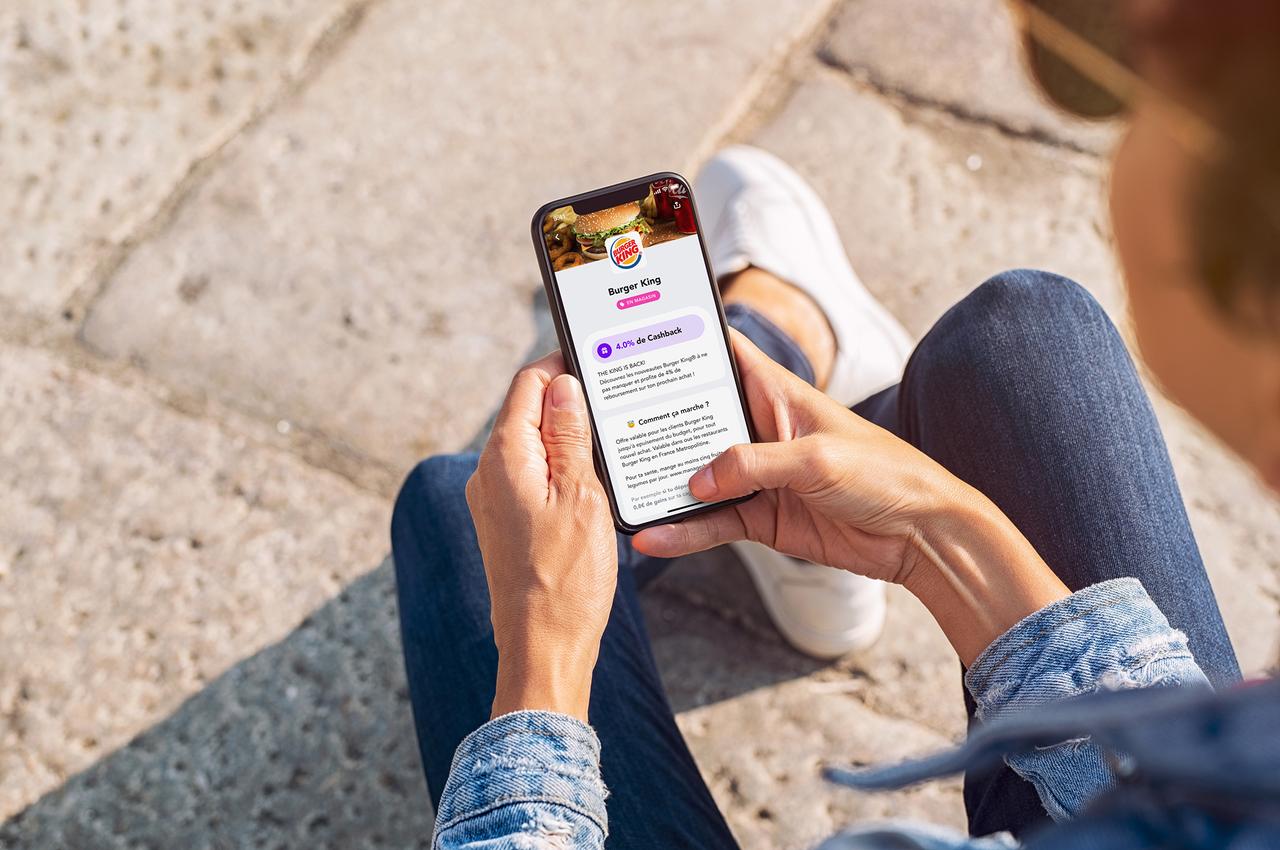

With the use of ALO and CLO (Card Linked offers) systems, consumers can walk into a store, make their purchases, and receive instant notifications letting them know they just earned a cash reward at a participating store. ALO and CLO rewards tech has been available to users across France and Belgium for years and has now arrived in Spain.

Goin, an app that allows users to achieve their financial goals by automating their savings and investments, offers clients this same experience. Merchants such as Uber Eats, Starbucks, Veepee, and many more see the value and are rewarding participating users for their purchases.

Goin has reached a 66% opt-in rate of active users in just two months and continues to see strong growth and engagement, resulting in their users regularly earning cashback rewards.

David Ruidor, CEO of Goin, noted how "the ease of use of today's cashback solutions allow them to become a key feature of money management applications. Our focus is providing a finance management and savings tool that helps users achieve their goals in the simplest and smoothest way possible, also with small rewards for their purchases. The automatic nature of new-age cashback systems aligned with that singular goal fell perfectly into place within the Goin app."

Creating a win-win situation for all participants

Regardless of the user engagement seen in past programs, there wasn't enough value for the banks managing them. The costs of implementing and running such a program were in some cases prohibitive and hard to justify. Large-scale efforts, seeing Spain's most prominent banks come together, eventually faltered and were shuttered.

Not only did the experience leave users frustrated and wanting more, but the programs themselves also didn't manage to create value for the banks.

However, what was a time-consuming, error-prone, and money-burning product for banks has become a source of revenue. Every time an end client earns a cash reward, the bank gets a percentage, much like the revenue generated from interchange rates; however, in this instance, paid with marketing budgets instead of by bank clients. Banks have always sat on the invaluable purchase data their clients generate but haven't extracted value from it. With a rewards program that retrieves the informed consent of their users, banks can finally put this data to use and leverage an opportunity to create a new stream of revenue.

Moving from affinity partnerships to payment marketing

Brands are eager to innovate and use new data sources to find incremental revenues, and payment marketing fits the description. Before the availability of payment data, merchants were effectively blindly throwing darts at the board and not hitting the target when funding affinity partnerships. Cashback systems of the past couldn't provide the customer insight necessary to target consumers precisely, resulting in merchants rewarding users who may have already made purchases at their store. PSD2 created an avenue to leverage this data by improving the technical standards and retrieving the user's consent, giving retailers a direct route to new customers. Not only is this data available, but it's also fully compliant with GDPR. This data remains protected by banks, pseudonymized, and only given for the purposes of rewarding customers to assure the highest level of privacy and that no personal information is ever shared.

The holistic nature of purchase data has allowed retailers like Starbucks, Uber, Veepee, and other merchants to leverage payment data to acquire new customers and address existing ones with Goin and an entire network of banking partners. Whether for acquisition, retention, drive-to-store campaigns, or an omnichannel approach, brands now have the performance marketing platform needed to generate incremental revenue with this precious resource and reward their clients with cash. The ability to tie in these factors and include a CPA model also allows merchants to justify allocating larger budgets dedicated to reward programs funded by payment marketing.

The opportunity has never been riper for the picking, and banks hold all the cards. With payment data, banks can take a slice out of the performance marketing pie that big tech has held on to ever so tightly modernize the old interchange rate revenue model.

Interested in learning more about our white label loyalty solution, creating great customer experiences, and growing your business with PayLead? Schedule a call