Is cash still king in 2020?

PayLead’s data team decided to look into our relationship with money, and more specifically, with cash to see how confinement has altered a longstanding consumer behavior.

While Covid-19 caused French residents to go into full lockdown from March 17th to May 11th, a variety of unexpected consumption patterns started emerging.

PayLead’s data team decided to look into our relationship with money, and more specifically, with cash. In this analysis, we focused on the anonymous data of our users who made at least one ATM withdrawal per month in 2020 before the lockdown and then compared it to their behavior during and after confinement.

Below are the results of our analysis, displaying an interesting behavioral shift caused by the quarantine.

Behavioral change during and after French lockdown

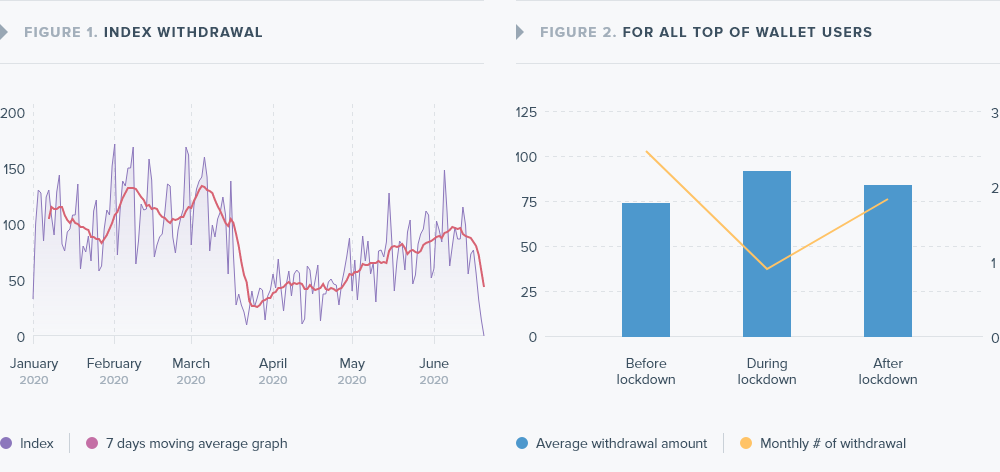

Figure 1.0 depicts the evolution of our withdrawal index over time (the 100 basis reflects average consumption in January). The first fluctuation of note is the steep fall, which starts on March 17th, that continues to plunge towards zero until the end of the month, where the index starts to show a slow rebound in withdrawals.

When looking closer at the data (figure 2), we can see that the overall number of ATM withdrawals during the lockdown period fell to approximately 1 per month per user, compared to over 2.7 monthly withdrawals per user in the period before confinement. However, the average amount withdrawn grew significantly while people were bound to their homes. After the end of the lockdown, the number of withdrawals started to rise again, but could not match pre-confinement levels.

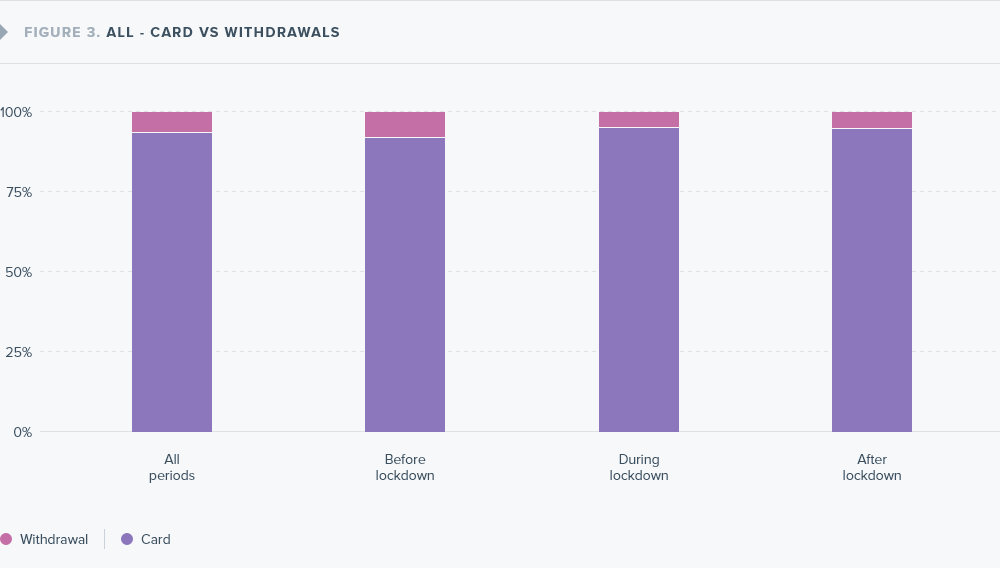

Of course, cash withdrawals only represent a tiny fraction of French consumers’ monthly spending. As you can see in the above chart, which depicts the ratio of card transactions and withdrawals:

- Before the lockdown, card transactions accounted for 92.1% of all transactions

- During the lockdown, card transactions rose and made up 95.3% of all transactions; cash withdrawals represented a mere 4.7% of French consumers’ overall spending (resulting in a 41% decrease over this timeframe)

Post-lockdown, card transactions continued to stake its higher than usual claim on spending, remaining at 94.7%. This number might reveal a long term trend starting to take shape, which may accelerate the decline of cash withdrawals.

Beyond these general trends, we also identified significantly different behaviors among French consumers.

The four main groups of consumers

Looking closer at the transactional data from our anonymous consumers allowed us to segment them based on their consumption patterns.

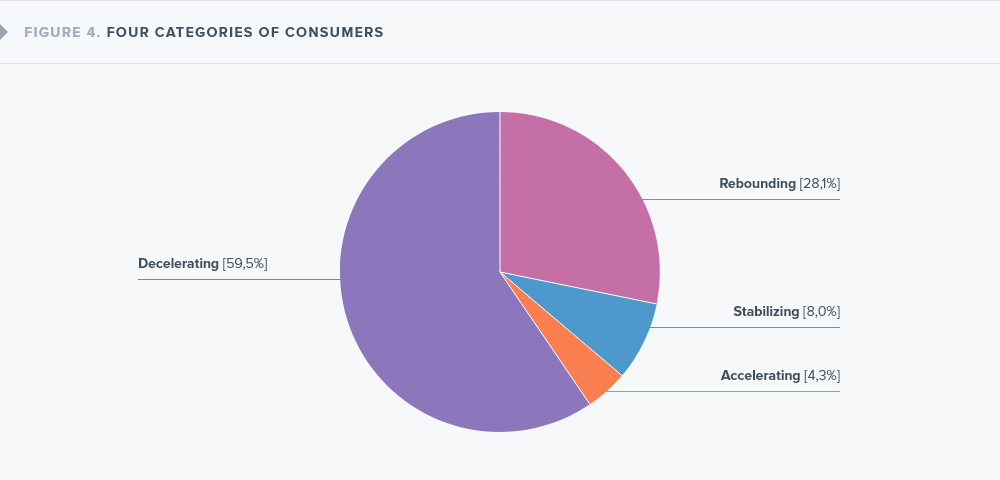

We identified 4 main groups of consumers:

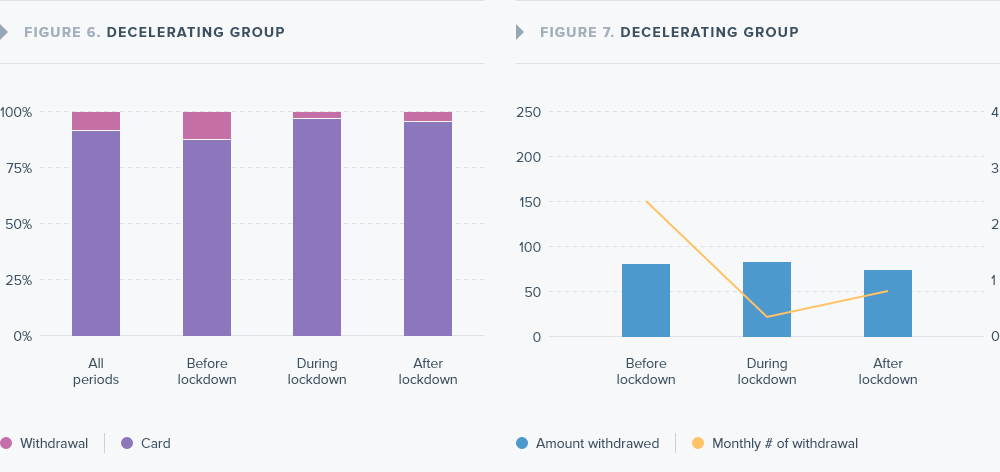

- Consumers who reduced the average amount of cash withdrawn each week during the lockdown and kept withdrawing less than ‘usual’ after the end of the lockdown (whom we named the “Decelerating” group)

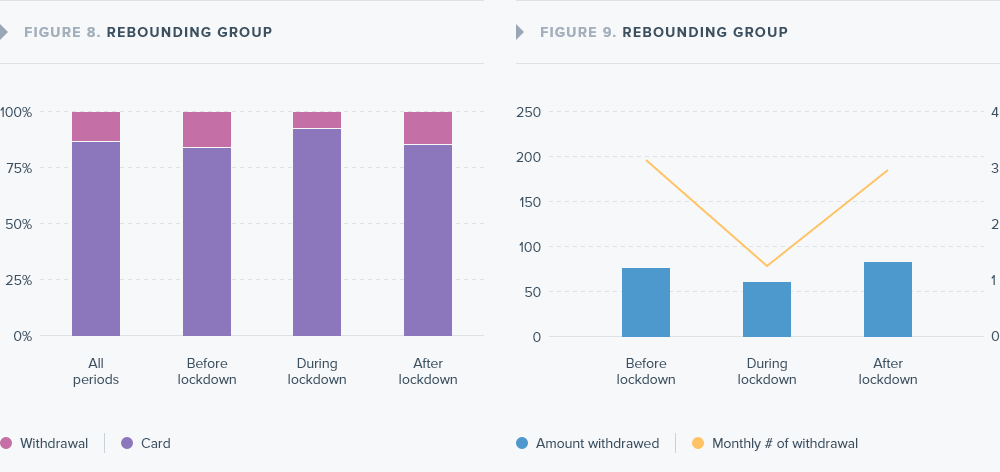

- Consumers who reduced the average amount of cash withdrawn each week during the lockdown and resumed withdrawing more money after the end of the lockdown (whom we named the “Rebounding” group)

- Consumers who withdrew significantly superior amounts of cash during the lockdown, and slowed down on their withdrawals after the end of the lockdown (whom we named the “Stabilizing” group)

- Consumers who withdrew significantly superior amounts of cash during the lockdown, and maintained that higher pace after the end of the lockdown (whom we named the “Accelerating” group)

The above pie chart reveals that the vast majority fell into the “Decelerating” consumer group (59.5%), followed by “Rebounding” consumers (28.1%). Data shows almost 9 out of 10 consumers slowed down their cash withdrawals in lockdown, with 6 out of 10 maintaining this habit after confinement.

After the quarantine announcement of March 16th, the entire market collapsed, which is depicted by a steep drop in the curve that eventually flattened out and remained stagnant during the lockdown.

From May onwards, our withdrawal index started to rise again, and pre-confinement consumption patterns began to reappear. Most notably, the usual spike in withdrawals recorded at the beginning of each month (which is noticeable in January, February, and March 2020) resumed. However, the index is still significantly weaker than before and might be explained partly by the reluctance of most people to handle cash, for fear of contamination.

Our key learnings

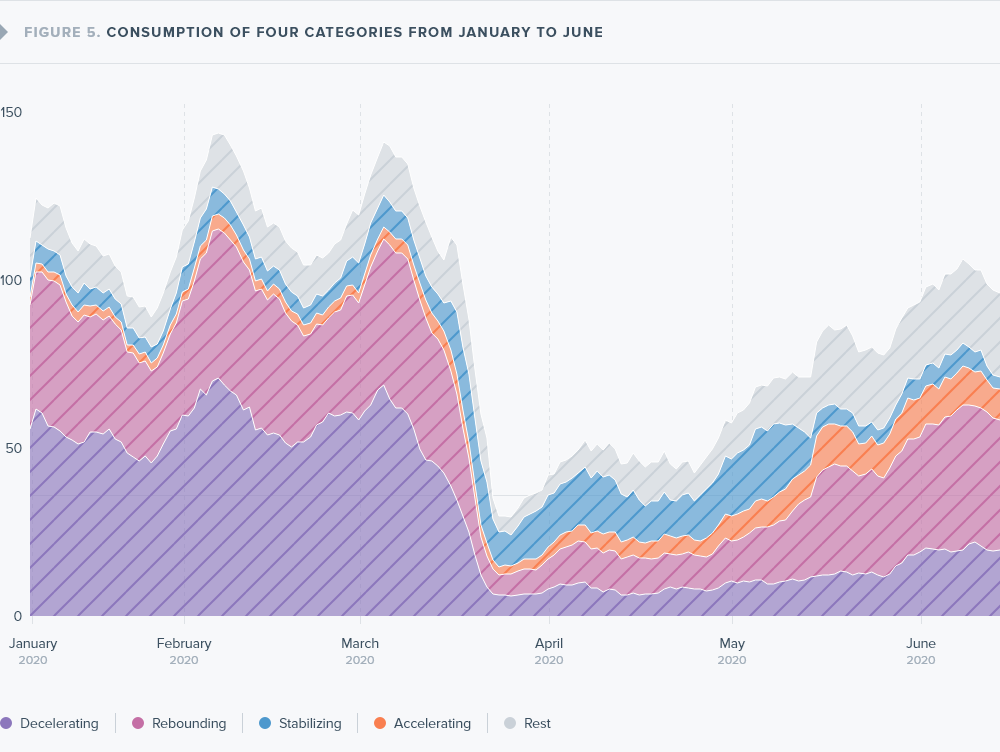

The Covid-19 crisis has struck our economy hard. However, it is even more interesting to look at micro trends and patterns among our various consumer segments, not only in terms of amounts withdrawn but also in terms of withdrawal frequency.

After the end of lockdown, our “Decelerating” group resumed withdrawing approximately the same amounts of cash each month, but at a much slower pace, falling from 2.4 withdrawals a month to only 0.8 times on average.

Last but not least, our “Stabilizing” group did not alter their withdrawal frequency but started to “stock up” on cash during confinement, having withdrawn, on average, over three times more money than before the lockdown.

Given our analysis of the data, the 2-month lockdown seems to have put in place new consumption patterns that have altered our relationship with cash. New sanitary concerns, coupled with reduced shopping trips, have caused ATM transactions to plummet. With the lockdown behind us, cash consumption is still visibly struggling to pick up the pace it once held before the pandemic took a stranglehold on the economy. Is it safe to say that the French containment has accelerated the transition to cashless payments? Only time (and data) will tell!