Loyalty for all : creating value for banks, merchants, and their valued customers

With the feedback of our financial institution and merchant partners, we developed a new offer for cardholders that rewards all parties.

It’s a strategy created to not only deliver more loyalty for merchants, but also increase retention for our banking partners looking to bring more offers to more users eager to earn more rewards in return for their loyalty.

To no surprise, we called it the loyalty strategy.

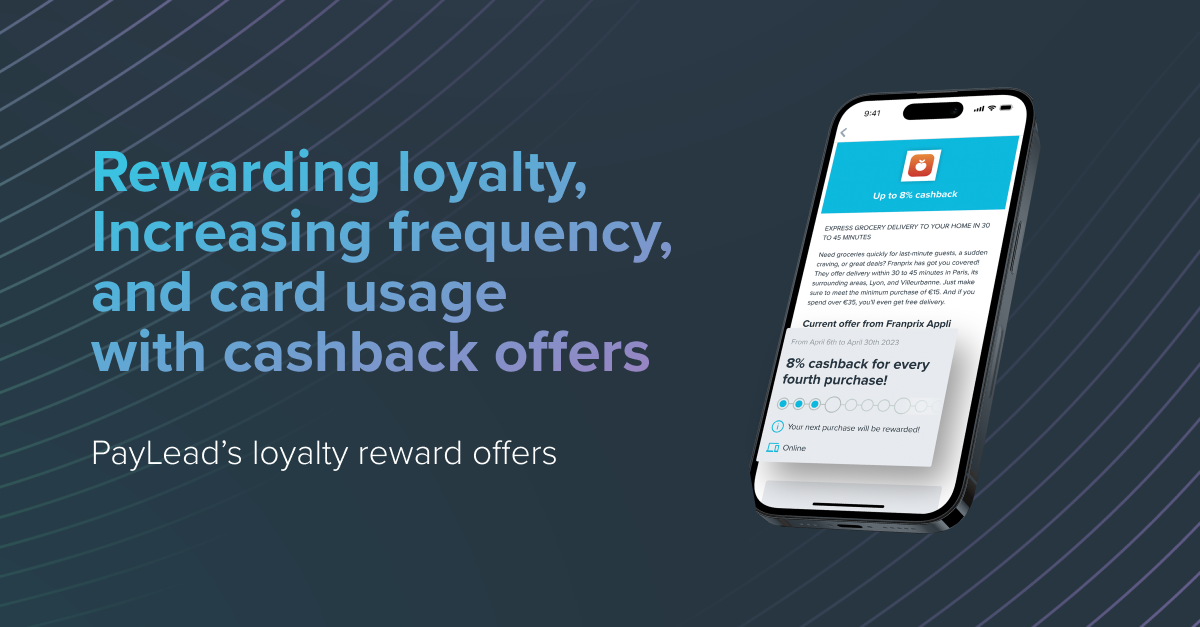

This new type of strategy has been developed to let merchants and program Managers reward consumers after making a defined number of transactions. Placed alongside regular offers, eligible users will start to see loyalty strategy-based offers in the apps of our banking and fintech partners.

Building bonds with merchants

The key to this strategy for merchants is the frequency aspect. Frequency is the main factor, and merchants will be able to craft a strategy that rewards bank clients for making multiple purchases with them.

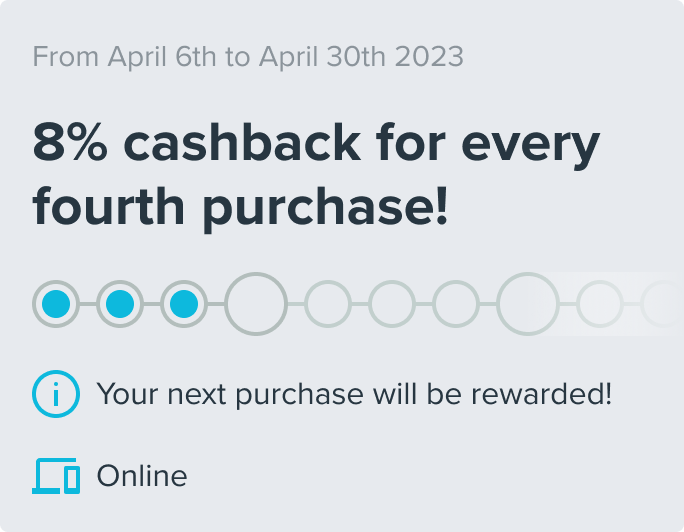

When creating a campaign, merchants intent on building loyalty, can select the Loyalty objective and set the desired purchase frequency cardholders must meet to earn a reward.

When the last transaction has been made, the reward is triggered, and the client earns their cashback reward. Once the reward has been earned, the counter resets, and the bank client can start making more purchases to earn another reward after meeting the purchase frequency once again.

Capping

We have included a capping function that allows merchants to limit the number of rewards per consumer.

Increasing client retention for financial institutions

We’ve been listening to our partners and keeping our ears alert to trends in the CLO industry, and we decided to move forward with this offer type that is built to help all parties. There have been many calls to innovate and find new ways to provide more consistent rewards to a larger audience of clients. This new offer answers those calls and is available to more users who may already be existing customers of a brand.

This gives cardholders added incentive to make use of bank cards that reward them for more of their purchase decisions. What’s the effect? While we haven’t received enough data since launch, the hope is to see an increase in transactions made, rewards earned and the average revenue per user (ARPU).

A win-win-win solution

Plain and simple, this new offer ensures that bank clients receive more offers and earn more rewards. PayLead’s goal is to seek out new ways to bring tangible value to clients, and now alongside targeted offer types looking to acquire new clients or increase brand wallet share, bank clients will be rewarded for choosing to make purchases with brands eager to earn their loyalty.

Want to know more about our automatic cashback solution and how you can enrich your customers' shopping experience? Schedule a call