Meet the Transaction HUB, PayLead's secret for turning data into value

PayLead’s Transaction HUB was built to turn unstructured information and banking transactions into rich, actionable (and anonymous!) data. Dig deeper into our technology’s secret sauce.

Open banking unveils new opportunities for merchants and banks. When we say value, we mean it. For readers who are not familiar with us, PayLead operates loyalty programs, that are powered by ALO (Account Linked Offer®) : our home-made technology, which enables any organization to run a dedicated, seamless and plug and play rewarding program for their customers, based on the analysis of their transactional data.

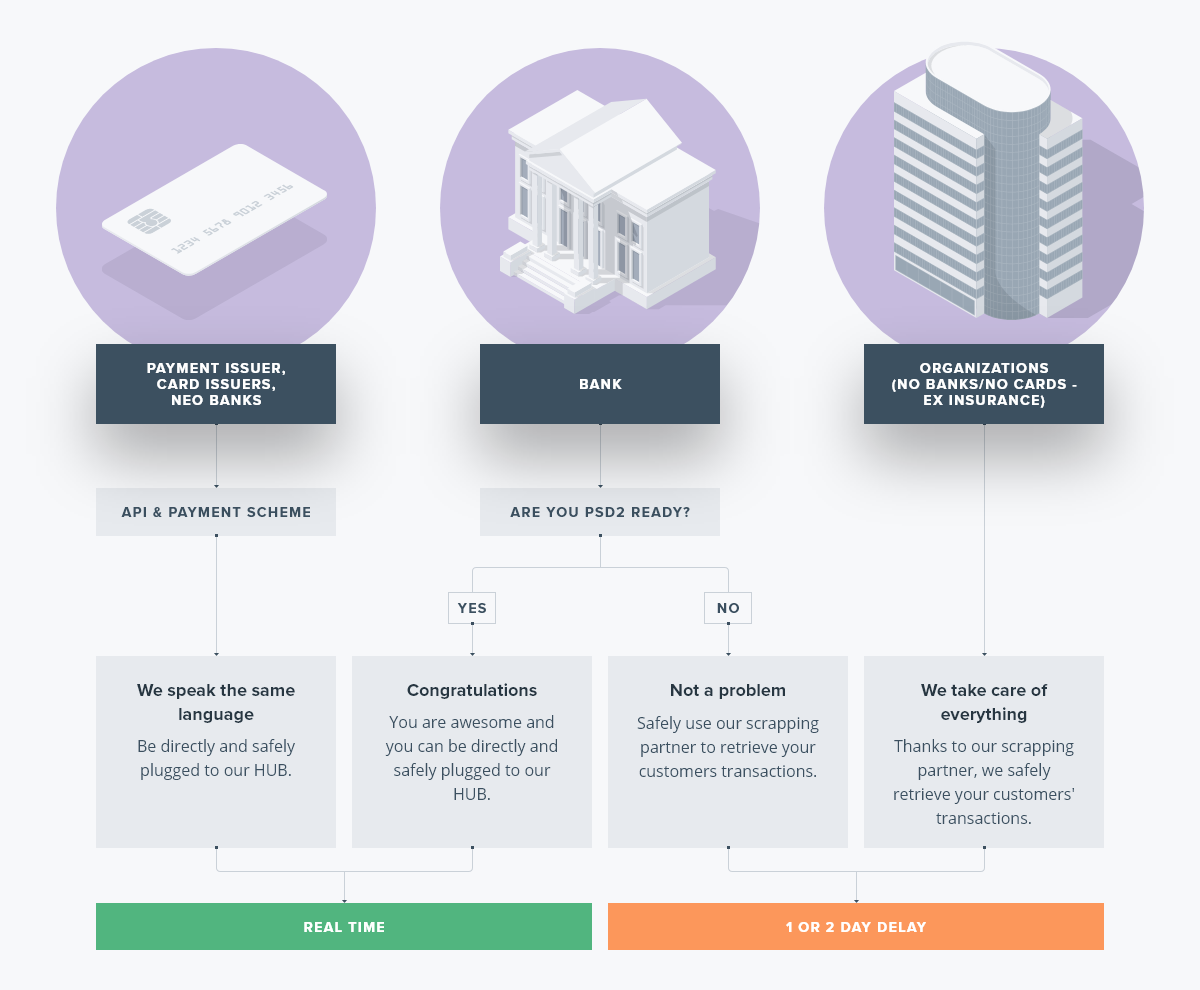

By organization, we mean anyone who has access to their customers’ anonymized transactional data (with their consent, of course) :

- Traditional banks (for instance, BNP Crédit Agricole, BPCE …)

- Online banks (ING, Boursorama, Fortuneo, Hello Bank…)

- Insurance companies, such as our clients Groupama, Axa...

- Neo banks ( N26, Kard, Vybe, ...)

- Large retailers (Cdiscount, Fnac, Rakuten…)

- Card Issuers, for instance Cetelem group, Lydia, Swile, Sodexo, …

- Traditional online cashback players (iGraal, Poulpeo, Capital Koala…)

A few years ago, transactional data belonged to banks and issuers. However, with the PSD2 European Directive, which came into force in 2018, the ownership of this data shifted towards customers. Today, if a customer gives their consent, organizations like PayLead can fetch their transactions (anonymously), which allows us to access their previous purchases and reward them accordingly, on behalf of merchants.

This is how today, PayLead enables any player (Banks, Insurances, Neo Banks, Portfolio Management Systems, Online Cashback players etc…) to seize this new opportunity, which will transform the open banking world, and to operate cutting edge loyalty programs. How ? By using our powerful system, the Transaction HUB.

Meet the PayLead Transaction HUB, a robust data-cleaning system

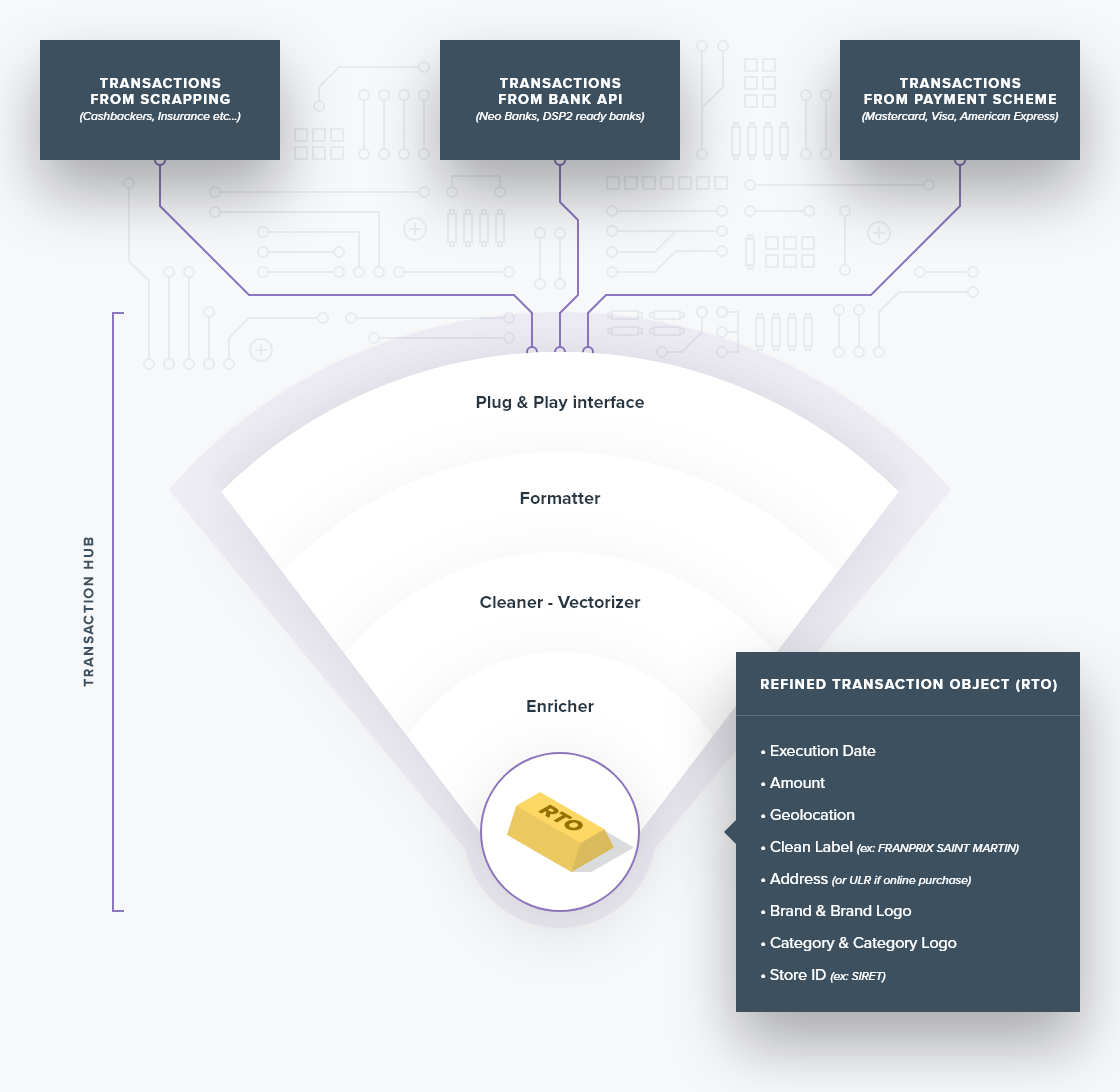

The Transaction HUB delivers consolidated, clean and sorted transactions and various data, gathered from various sources (from bank’s core systems to scrapers’ databases). It is the foundation of our omnichannel and tailor-made loyalty programs.

It all starts with a problem: all players on the market are not equal when it comes to their data formatting. Indeed, there is no standard on the market, which means that quite often, the transactional data PayLead retrieves is unstructured : different formats, different standards, and different levels of information are communicated to us, either through API, or manually.

This is why we needed to develop the Transaction HUB : this system allows us to retrieve transactions from all sources and turn them into a single, standardized, clean format. This is the very foundation of our activity, and it gives PayLead the ability to adapt to any format of transaction.

The Transaction Hub is a scalable solution, designed for centralized management and to enrich large volumes of transactional data. This plug-and-play product combines the best security technologies with a cutting-edge machine learning algorithm.

It offers our clients a channel for their collection and payment transactions, supporting various countries and using international standard formats. The HUB automates an end-to-end process of collecting, sorting out, cleaning and enriching data while ensuring it is correctly processed, and removing payment duplicates.

Here’s how it works:

The HUB operates in 5 steps :

Step 1 : The Plug & Play interface

First, we plug our clients’ system into the HUB, to start retrieving the data!

Step 2 : The Formatter

The Formatter turns each transaction into a standardized intermediate object, ready to be cleaned and enriched. At this point, there are two main options :

- We have not retrieved the merchant’s ID - in that case, we need to infer it with the help of steps 3 to 5 (see below)

- We have retrieved the merchant’s ID (which is the case when we receive the data from banks or payment schemes for example) - in that case, we are able to map it directly and process the final data

Step 3 : The Cleaner

The Cleaner helps us label all transactions. Most of the time, the payment labels we can see in our bank accounts are quite vague. You probably already wondered what some of the transactions which popped into your account were, and struggled to remember to what they corresponded! Let's take a look at an example:

300716 CB*766506573 PVCDISTRIB 92LEVALLOIS PER!

If the above transaction label looks familiar to you (and absolutely impossible to decrypt), you’re not alone. This is because each bank enriches the initial label from the merchant, with their own patterns and conventions. Worse, they often truncate the labels then, because they need to abide by a maximum display size!

So eventually, data becomes unreadable and unclear for humans to process.

The Cleaner removes the “noise” around these labels, and works to retrieve the initial and “clean” store label. Based on machine learning, this feature of our HUB acts like a human brain and knows what’s important, and what’s not.

Step 4 : The Vectorizer

This step is where most of the magic happens. Our deep learning engine takes the “cleaned” transaction, and, just as a human brain would do it breaks the original label into elements and recognizes composed, truncated or complex elements such as :

- cities

- brands

- stores

- localities

Each element is turned into a dimension - making each of our transactions multidimensional!

Step 5 : The Enricher

Last but not least, PayLead enriches the data. After step 4, the HUB has produced an object which is now human-friendly, but not yet machine-friendly. This is the point of the Enricher: turning any transaction into what we call a RTO : a Refined Transaction Object. In other words, we add our own data to each transaction :

- Based on the transaction’s city and department, we are able to extract the exact city ID (postcode), and its geolocation

- Based on the store’s name and the city, we are able to infer the store’s SIRET, even for the trickiest store names (This one was definitely not a walk in the part for our data team, and is one of the ingredients to PayLead’s secret sauce)

- Based on the SIRET, we retrieve the Brand’s name, its logo, the address, the exact geolocation of the store, and much more!

Meet the PayLead Transaction HUB

We built this end-to-end process to retrieve proof that customers have made purchases that are eligible for rewards. However, beyond this goal, perspectives are mind-blowing. Through this high volumes of pseudonymized data we are able to draw a complete picture of any given consumer retail activity, and identify the brand, channel of purchase (online or offline), country, regions, and catchment zones.

Our team regularly posts articles and statistics about this on our blog - follow us for more information!