How the two-sided capacities of platforms change the way consumers shop, pay, and borrow

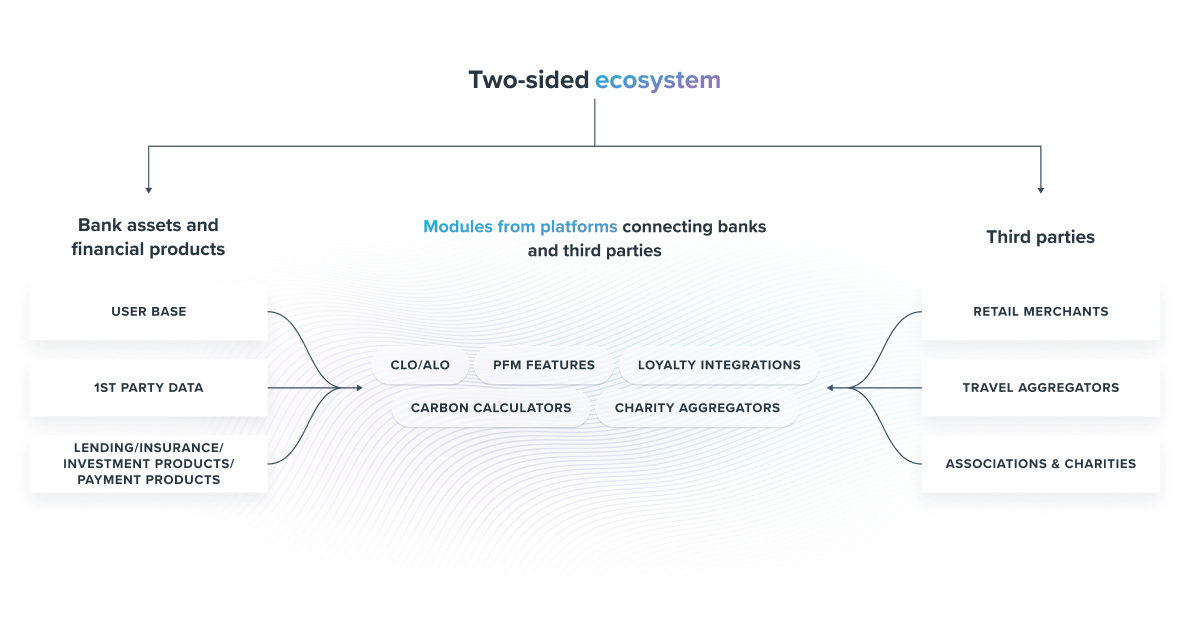

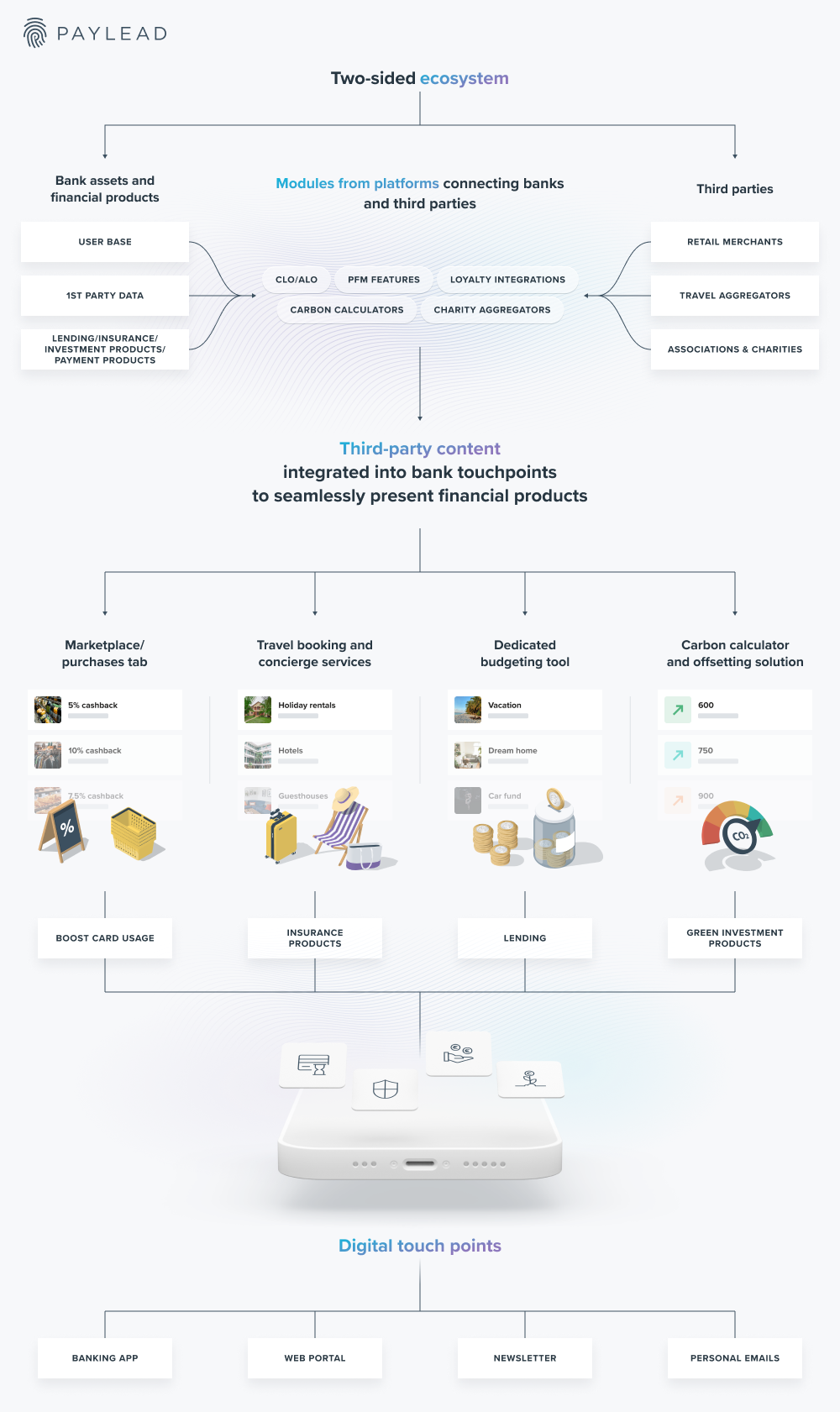

Banks and fintechs are creating a two-sided ecosystem to bring their banking as a media strategy to life by displaying third-party content to personalize the experience for their clients. And it's playing out before our eyes.

Imagine you're planning your next vacation, browsing through your favorite flight aggregator to find the best deal. You get distracted, look at your phone, and think of looking at your bank account. You log in and immediately notice a new tab dedicated to travel. After a few short scrolls, you come across an offer for a vacation package at the destination you had in mind.

You take a closer look, and not only does your bank offer a competitive price, but they:

- Package in insurance

- Give you a cashback reward for booking with them

- And you can book now and pay later without ever sharing your card details.

Not a bad deal. This ends up being an experience that will make you think twice before booking a vacation elsewhere.

Your bank is actively working to make this happen, and it's all part of their strategy to utilize platforms that provide third party content and offers. In this article, we show how platforms are creating two-sisded ecosystems that are changing the way consumers shop, pay, and borrow.

These ecosystems provided by platforms allow banks to leverage their assets, such as customer touchpoints and banking data, to diffuse personalized content to users where banks can present relevant financial products.

Currently, most banks are not fully leveraging the touchpoints at their disposal. They are cramming offers for multiple financial products into the same welcome screens and newsletters that all clients see and receive.

This forces every department selling a financial product to fight for the same spaces across a few customer touchpoints and creates pressure to prioritize their most profitable products, like mortgages. This results in a less-than-stellar experience for clients, who may get repetitive emails or in-app ads with irrelevant offers and fewer opportunities for banks to sell the right financial product at the right time and place.

platforms aim to integrate modules into existing customer touchpoints that collect first-party data and use AI to service clients with content that includes personalized offers that will increase their engagement, card spending, and use of financial products.

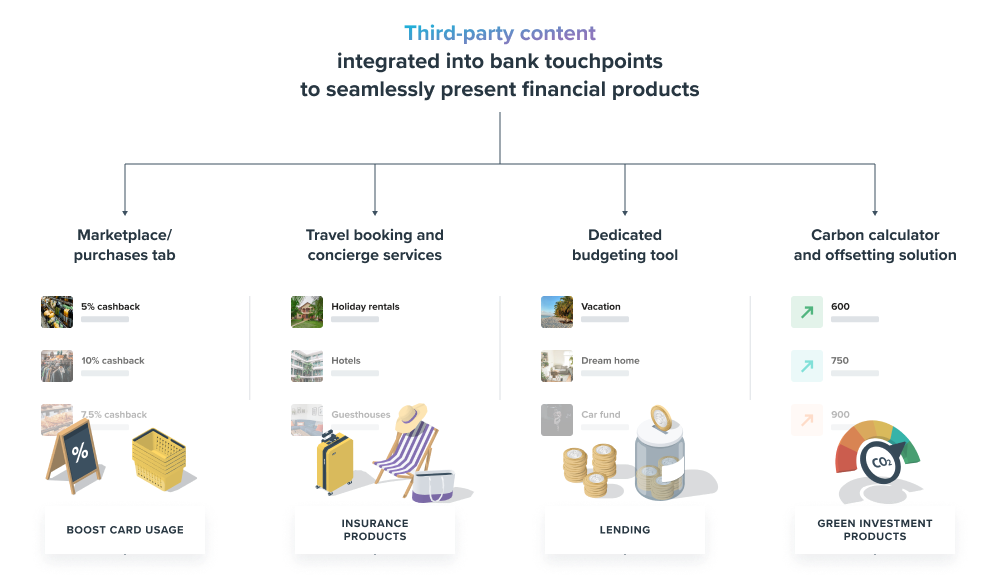

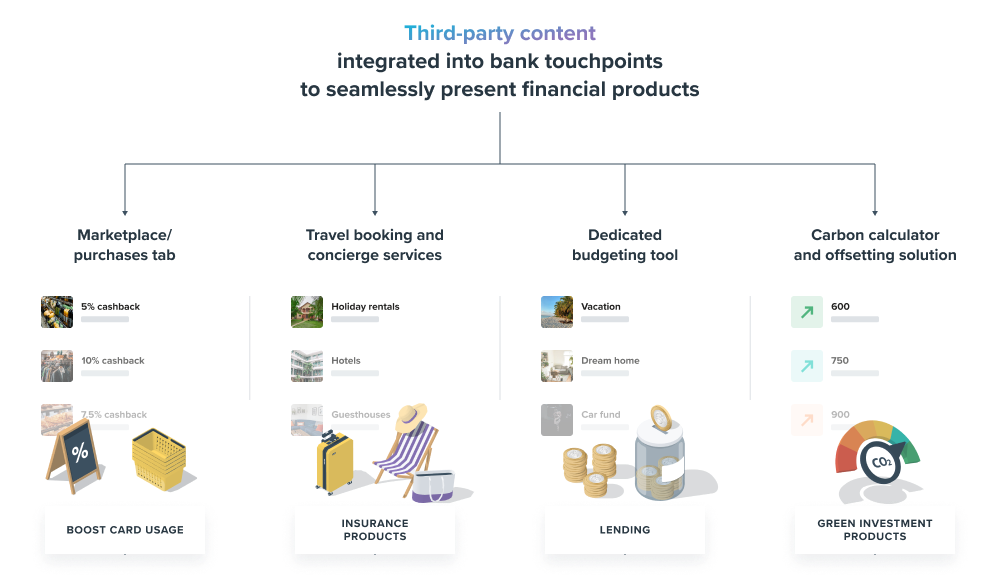

What are some examples of modules fuelled by two-sided ecosystems?

Your banking application is the first place you'll see new features where banks can disseminate content. These features may be a new personal finance management tool where clients can categorize savings for different goals, whether for a car, home, or vacation. Or it could be a new purchase or travel tab in a banking app offering bank clients an end-to-end experience to make important purchases and book vacations.

In all three cases, banks collect first-party data to identify the ideal financial product to present to clients. The new budgeting feature introduced by the bank could intuitively determine what users are saving for and be the perfect place to present lending offers to help clients reach their goals faster. While the purchases and travel tabs would be the ideal channel to insert insurance products tied to vacations and buy now, pay later options at checkout for big-ticket items.

These are just a few examples. Banks will no doubt test a bevy of new features where they can publish content across banking apps, newsletters, and web portals, creating their digital shelves to seamlessly integrate their financial products in a personalized and relevant manner.

All the ingredients (assets) to make it happen

The ecosystem is driven by three main assets banks have cultivated and are primed to leverage. Those being their:

- User base

- Unmatched 1st party data

- Industry-leading financial products

Financial institutions have long held massive user bases and leading financial products, but the data they reserve access to is the main ingredient fuelling platforms that offer a two-sided ecosystem for banks and third parties.

Payment data is possibly the most valuable type of 1st-party data available to marketers. Payment data allows for action-based payment marketing that segments clients based on their purchase history. Whereas other data-centric platforms that leverage data to provide marketing opportunities, like social networks or search engines, can only target customers based on what they intend to buy.

This data allows financial institutions and third parties plugged into a two-sided ecosystem to better segment and service clients with hyper-personalized offers in banking touchpoints.

Building a two-sided ecosystem

Banks are starting to realize the potential of a two-sided ecosystem and are moving swiftly to Identify fintech companies with turnkey solutions that leverage their assets and include third parties to serve consumers.

Leading financial institutions like JPMorgan Chase acquired and integrated a travel platform within its banking infrastructure that allows consumers to browse and book travel. In this instance, they acquired the technology and the third party to serve their clients within their closed ecosystem. Marianne Lake, Co-CEO of Consumer and Community banking, highlighted the venture noting,

"We saw an opportunity during the pandemic to own our own destiny in travel, and we acquired cxLoyalty, a proprietary, two-sided travel platform, and Frosch, itself a top ten leisure travel agency, providing us now with the booking engine, the content, the servicing excellence and the concierge capabilities that our customers should expect. And today, we estimate we are a top five U.S. consumer travel provider. "

With their travel platform in place and an audience of over 66 million U.S. households, JPMorgan Chase is leveraging a two-sided ecosystem that drives customers to their digital channels where they'll consume content and no doubt present offers for financial products.

Other leaders in the financial services space have taken an open-ecosystem approach driven by platforms that integrate third parties instead of acquiring them outright. Revolut launched its Stays feature that plugs in hotel and rental bookings from Expedia and VRBO to provide the content that feeds the feature in the app. More recently, they partnered with Viator to launch their Experiences feature, allowing users to book activities from the Revolut app.

4 ways it will change how consumers shop, pay and borrow

Embedding shopping into the banking experience

Banks are actively intertwining themselves into and simplifying the purchasing experience. As mentioned above, JPMorgan Chase implemented a travel channel into their ecosystem and has plans to include dining and shopping experiences by introducing the platform to third parties. The idea is to make JPMorgan Chase the best place to pay, borrow, and shop. As mentioned earlier, Revolut quickly followed suit moving into the travel space with the launch of their "Stays" feature, where users can book accommodations.

These new travel features embedded into JPMorgan Chase and Revolut's bank applications present a steady flow of traveling content and keep their clients in their ecosystems, increasing their card usage and exposure to financial products like travel insurance.

Enriching the payment experience with rewards

Banks are looking to simplify and enrich the shopping experience for clients willing to share their pseudonymized data and play their part in the two-sided ecosystem. Automatic cashback rewards act as the content enriching the payment experience for clients, which gives them the incentive to use their bank's debit or credit card, and provides banks the ability to unlock their client's payment data, present content from third-party merchants, and see a meaningful increase in card spending. PayLead is one example of a platform providing a two-sided ecosystem bridging the gap between banks and merchants, bringing tangible rewards to European consumers.

With over 30 banking partners across Europe, PayLead has developed and scaled a reward model that facilitates data exchange within this two-sided ecosystem to increase the card usage of bank users and reward EU citizens for their purchase decisions.

Making payments as frictionless and secure as possible

The checkout experience is the most crucial moment of any purchase journey, and banks have the means to remove the cumbersome experience of searching for credit cards and inputting information.

Direct payments are primed to become a cheaper and faster way to purchase, and banks could offer their clients the ability to make payments without ever sharing payment information from the secure environment of their banking application. Companies like Fintecture are already embedding direct transfer as a payment method into retailers' e-commerce sites across Europe, making the solution readily available on merchant sites.

Banks can offer this same advantage to their customers internally to engage with clients in their banking environment and provide them with the best purchasing experience.

Changing the way you borrow

Borrowing opportunities will become more readily available to bank customers in the coming years, whether it be an offer for a mortgage presented within the budgeting feature of a bank or a BNPL solution when purchasing within a banking application. Banks will bring relevant borrowing opportunities to clients at an opportune time within their ecosystem, using the presentation of the third party's content as the ideal moment to better embed financial services.

The concept of dedicated budgets mentioned earlier, allowing users to create budgets for specific life goals, has already been implemented across the industry. UKRSIBANK, part of BNP Paribas Group, recently partnered with well-being startup Dreams, whose solution empowers clients to achieve their money-saving goals. This new tool, embedded into the banking app of millions of users, gives the financial institution the first-party data necessary to propose relevant lending opportunities to clients saving towards a goal they may want to attain faster with a loan.

See the full infographic depicting the strategy

Learn more about the results banks see from implementing a solution that serves their customers with actual value Schedule a call