Payment Marketing: What is it and how do I use it?

When businesses can access transaction data, they instantly unlock sales opportunities, both online and offline. This is what payment marketing is all about.

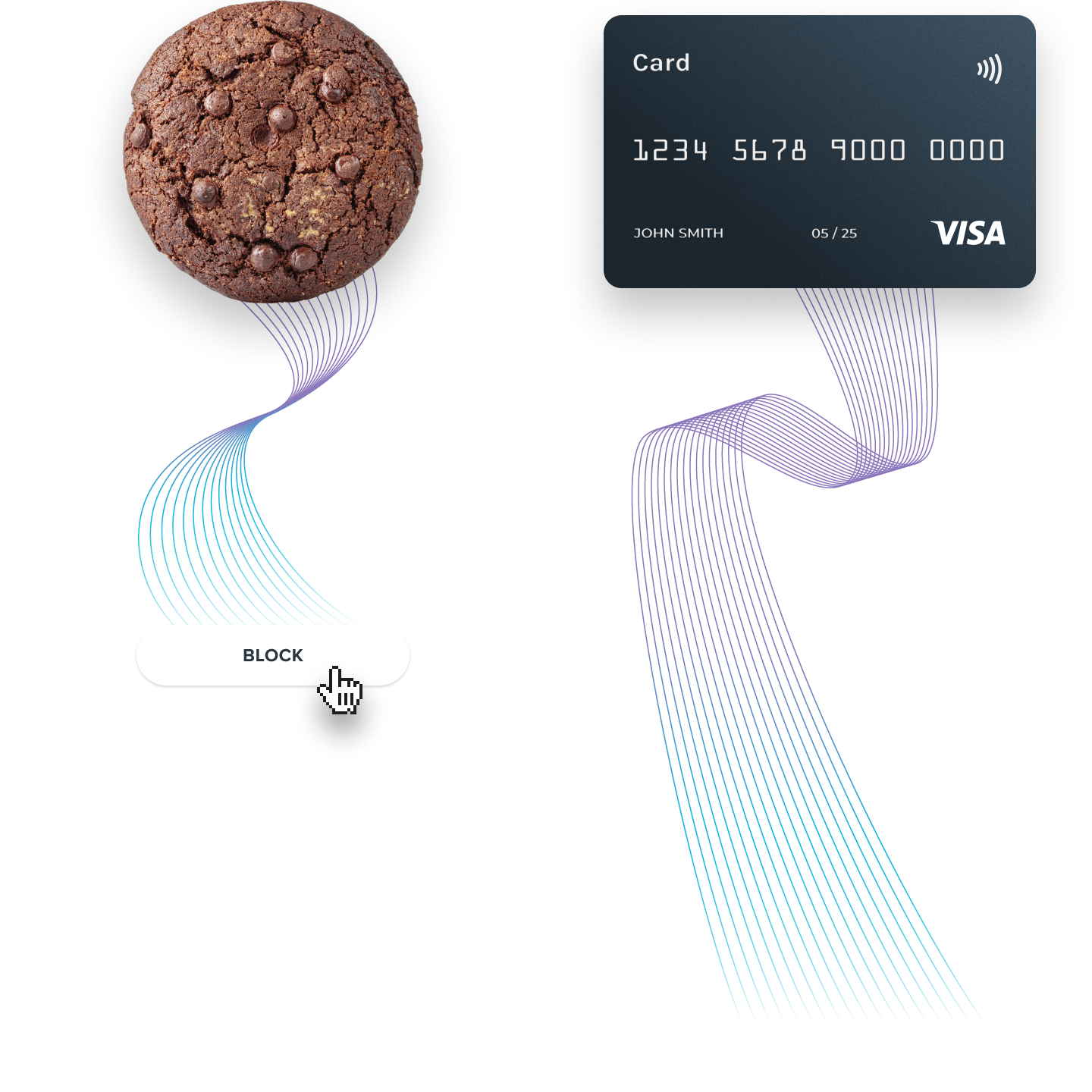

As Chrome closes the casket on cookies in 2024, transaction data is now attracting more attention from marketers. What's more? The platforms leveraging transaction data across networks with bigger audiences are gaining a more significant percentage of marketing budgets from brands redistributing resources as cookies make their exit.

Retail media's use of transaction data

Since their inception, retail media platforms have been utilizing transaction data to deliver targeted advertisements across their channels. They will undoubtedly see an influx of brands allocate more budget to leverage this resource. Forecasts see the channel accounting for as much as 25% of all media spending in five years.

However, transaction data within retail media platforms does come with limitations. Firms in the space must link purchases to customers who have logged into platforms. This narrows the audience for advertisers, missing out on new or occasional shoppers who don't have an account or don't log in before browsing. In short, transaction data within retail media platforms doesn't quite give the whole picture, as it only captures a user's buying habits within a single environment or network.

Accessing data directly from bank clients

However, EU regulations, such as PSD2 and soon PSD3, have paved the way for banks to share transaction data from consenting clients and redefine its use outside retail media networks. Bridges have been built between banks and marketing solutions that use transaction data to craft strategies, reach customers, and activate them.

With access to transaction data from consenting bank clients, businesses instantly unlock sales opportunities, both online and offline, with a cookie-less tool that can address audiences outside of retail media platforms. What we at PayLead call payment marketing is all about using transaction data to get a 360-degree view of a customer's purchase habits and making this data actionable.

PayLead's transaction-based solution: payment marketing

What exactly is payment marketing? It's a 100% performance marketing channel that uses transaction data from consenting bank clients to target audiences based on purchase behaviors.

Unlike intent data like browsing activity, search history, or social media engagement, transaction data gives marketers action-based data with a holistic view of an audience's online and offline purchase history. This resource gives marketers new segmentation opportunities to craft the sharpest campaign strategies supporting their business objectives.

With customer purchase insights, brands and retailers know where customers regularly shop, when they shop, how often, and how much they spend. PayLead's payment marketing solution falls squarely on using this precious data to address audiences with hyper-personalized offers crafted to respond to several strategies such as customer acquisition, retention, increasing wallet share, average ticket size and purchase frequency.

How does PayLead access transaction data?

PayLead works with a network of financial institutions and fintechs across Europe to provide account-linked and card-linked offers to their clients. After getting a user's informed consent to utilize their transaction data, our platform natively presents offers to eligible clients through cashback and reward programs within consumer banking experiences.

How does it work for marketers?

A marketer will choose their targeting criteria based on purchase history and send offers to incentivize targeted bank audiences in our network of partners. Our marketing platform then tracks purchases to identify customer actions and attributes the sale to an offer. Finally, the activated client is rewarded.

How granular can our targeting get? Would you like to reach out to potential customers who have not made any purchases from your brand in the past 12 months? Or perhaps you would like to target customers who used to purchase from you but have not done so recently? Maybe you are interested in attracting customers who currently buy from your competitors. Our platform can help you achieve any of these goals. Additionally, we can assist you in increasing customer retention and loyalty.

Welcome to a cookie-free world

With transaction data fueling our marketing channel, payment marketing doesn't rely upon traditional online measurement methods or cookies.

We analyze an audience's payment data and match each transaction with a brand and its campaign budget. The sole act of payment carries the necessary data for targeting and performance attribution purposes.

At PayLead we proactively ensure we never receive personal information connected to a transaction. We cannot access our audiences' names, genders, emails, or phone numbers. Nor can we gather information about their online journeys. So not only are cookies useless in payment marketing, but they also go against the essential notion of customer pseudonymization, which is a prerequisite for people consenting to share their financial data.

Concrete payment marketing success stories

We have established an award-winning partnership with one of the biggest supermarkets in France by effectively carrying out payment marketing campaigns. When Franprix and PayLead came together to put transaction data to use, we put both acquisition and wallet share strategies in motion to bring in new clients and increase brand loyalty among existing customers. The campaign saw Franprix increase its wallet share among new clients by 75 percent and see a 42 percent increase in average monthly spend from existing clients.

“This is precisely what PayLead's technology brings us: PayLead not only guarantees that we don't pay twice for the same sale thanks to its attribution technology, but it's also the most advanced solution we know of in terms of bank data analysis, which can prove incrementality.”

Virginia Fernet - Director of Client Marketing, Franprix

More recently we worked with Cooltra, an urban mobility solution operating in Spain and France, offering commuters electric scooters to get around town. Together we crafted a strategy that saw the brand gain considerable wallet share among customers in both France and Spain, and is now focused on retaining newly acquired customers.

"In 2024, we activated a retention campaign in France, which we didn't have before, and within just one month, have seen a substantial percentage of customers repeatedly ride our scooters. This leads us to the conclusion that our collaboration with PayLead is fostering retention."

Marta Barcelo Plans - Growth Manager at Cooltra.

The same proved true for Burger King, who saw similar success by running targeted customer activation campaigns with PayLead's payment marketing platform. Creating brand loyalty in the fast-food industry is notoriously difficult, given the highly volatile customer base. Of the clients who enjoy quick-service restaurants, 86 percent were found to dine at several chains. After running wallet share and acquisition campaigns, Burger King saw a 40 percent increase in purchase frequency from volatile customers, and 33 percent of their new clients returned within the following months.

PayLead's payment marketing platform can support multiple marketing strategies, and drive a significant amount of incremental sales, offering a high level of return on spend to retail brands that only pay for results.

What are the advantages of payment marketing?

Our payment marketing platform, PayLead Cube, is removing many pains that marketers traditionally encounter in performance marketing:

- Truly performance-based marketing model (CPA)

- Sales generation channel that works for both online and offline stores

- Audience targeting based on effective and proven purchases history, not just assumptions

- Plug and play solution - No technical implementation needed at all

- No Attribution challenges - No CPA duplication risk

- Cookie-free paradigm, while being fully GDPR-compliant

How do I start using payment marketing and drive incremental sales?

PayLead offers various banking and fintech audiences that can be accessed and targeted with our Cube payment marketing platform. Schedule a quick call if you want to get started and speak to an expert.