Payment Marketing – The path to transforming Open Banking costs into revenue

The industry's promise of turning costs into revenues is finally on the horizon.

The advent of Open banking sparked a race to provide more value, more features, and more integrations in daily banking experiences to initially reduce customer churn. However, the rush to integrate and keep up has led bank after bank into adopting solutions promising a bevy of benefits for users without any direct return on investment. The word value is plastered everywhere in messaging aimed at retail clients, and there is truth to that, but with features put in place mainly from a defensive standpoint, what value have financial institutions seen from the rollout of open banking solutions?

Spain had a head start on the Open Banking rush due to regulation and the willingness of established institutions to implement new solutions such as account aggregation, financial management tools, and varied credit offerings. But value, or what they are genuinely seeking, cost-cutting and revenues, have been hard to come by or make a real impact on bottom lines.

Industry expert and Partner at Kearney, Manuel García-Ramos, who has been active in consulting firms on Open Banking matters since its beginnings, noted that "Open Banking presented enormous promise for banks and their clients, but hasn't yet made a defining impact on revenues as consumer adoption has lagged behind the introduction of new features."

Despite Open banking's slow start, it still presents a clear outlet for new value, at a time when banks continue to see shrinking returns from traditional revenue models suffering from low-interest rates and the tightening of fees due to heightened competition. In a report conducted by Accenture, the decline in revenues is depicted by measuring the slow fall in banks' share of GDP across global markets. In Europe, excluding the UK, the bank's share of GDP fell from 5.8 percent in 2009 to 4.5 percent in 2020.

A mechanism that offsets costs and generates revenue

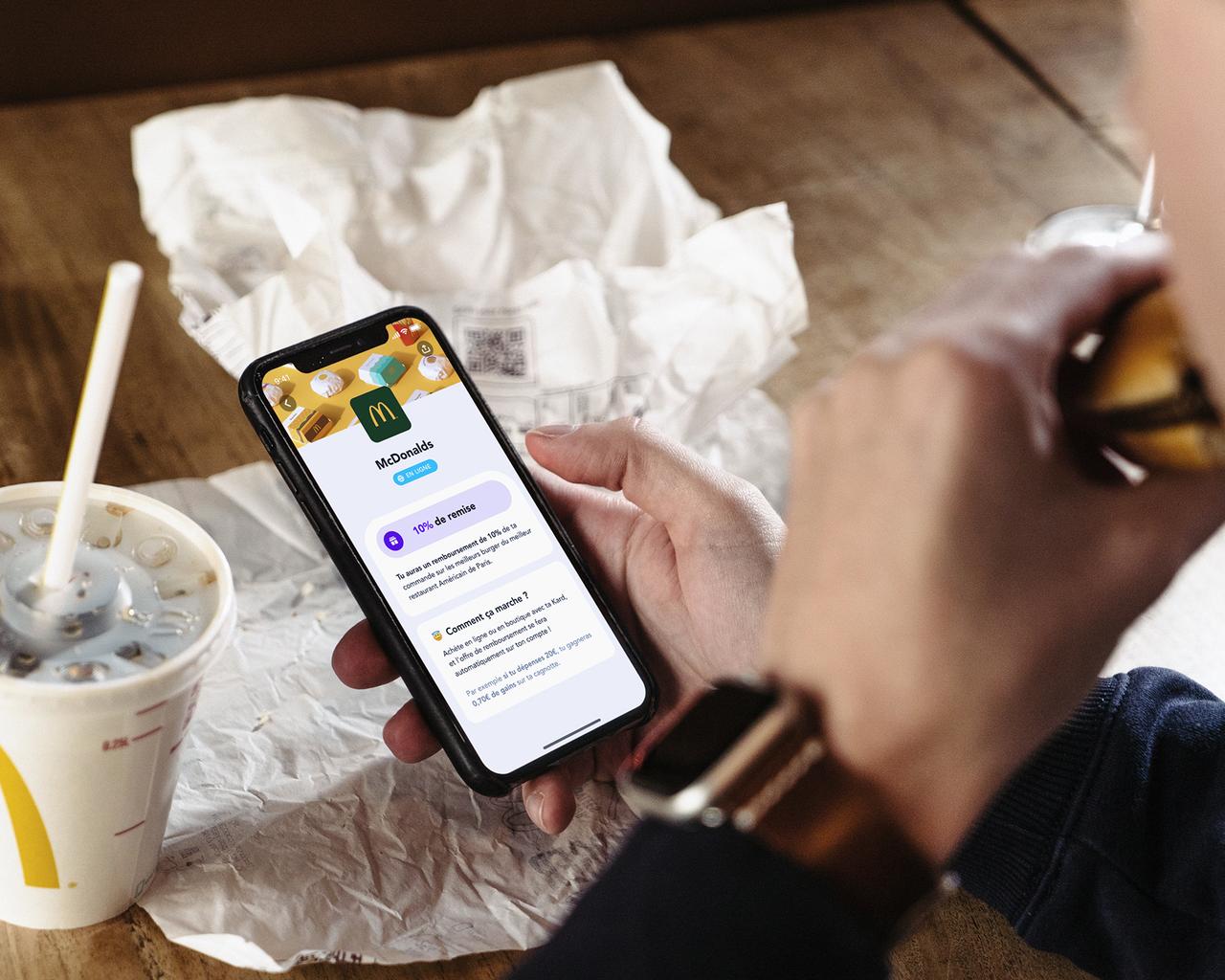

Despite the current costly defensive Open Banking strategies banks have in place, examples of revenue-generating solutions with proven results do exist. Payment Marketing is one of them. Lydia, for one, the European unicorn building a finance super-app, has tapped into revenues from a strategy that covers the cost of account aggregation and entices users to subscribe to premium card offerings.

Payment Marketing is a performance marketing channel that utilizes payment data to target potential prospects and clients based on their purchase behaviors.

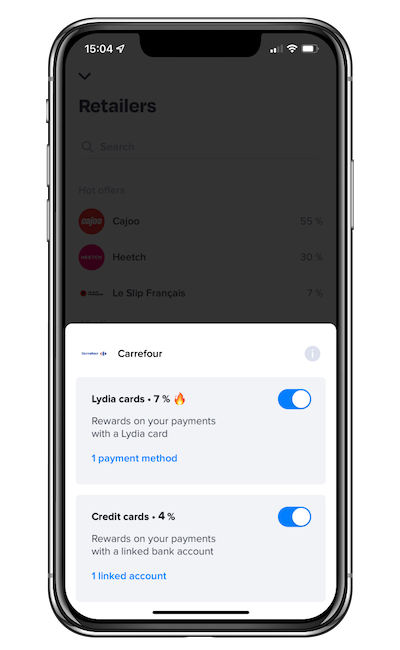

With a two-tier cashback system powered by payment marketing funded by merchants, Lydia receives a percentage of every reward earned by all participating users regardless of whether they use a card from another bank or Lydia's. However, by giving more generous cash earnings to Lydia card users, they're incentivizing the adoption of their premium card offering. The solution works to support its incumbent bank strategy by giving generous reward earnings to clients bringing in a monthly fee.

With this mechanism in place, banks and money-apps offering account aggregation can implement a means to offset the costs associated with aggregation solutions and eventually generate revenues with increases in customer adoption. On average, monthly account aggregation costs range from 10 cents to 50 cents per user. These costs leave banks and money-apps with climbing monthly expenses justified as a means to reduce churn. However, a growing number of solutions are finally recovering these costs.

Goin, another company leveraging payment marketing to offset costs and create revenue, is currently operating a rewards program that is the first of its kind in Spain, marking a new path for banks and fintechs in the region. While Goin does not issue bank cards, In both cases, Lydia and Goin are using a rewards model funded by merchants looking to target consenting users with personalized cashback offers based on their purchase history. This virtuous exchange ensures that all parties benefit from using payment data and cut costs or generate profits.

Alfonso Ayuso, CEO at Bornea Digital Assets and former Chief Innovation Officer at Banco Sabadell, highlighted that “Payment Marketing solutions provide a real revenue-generating use case that unlocks and monetizes banking data. The perceived added value is instantly seen by clients, who, through a seamless experience, receive actual cash in exchange for their data. Merchants reduce their acquisition costs while Banks obtain a return on their Open Banking investments. It is a WIN-WIN-WIN solution.”

Rapid consumer adoption of Open Banking solutions

Consumer adoption is a huge reason to feel optimistic about the future of revenue-generating solutions for banks. The latest Payments and Open Banking survey from Accenture asking executives in the industry what their prediction was for consumer adoption found that it will increase by 76% in the next three to five years.

With the masses set to make the jump in the short-term future, offsetting the costs of existing solutions will happen progressively, and adopting new third-party APIs will start to make sense again.

Lydia, and other financial institutions that have implemented a reward program have started to see significant increases in card usage and spending since launching. After receiving their first reward, the average increase in the monthly average basket across PayLead's banking partners was 41% with participating merchants. The overall monthly spend also saw a significant jump of 4.5x. The rewards incentive effectively changed the users' purchase behavior and made them use their respective banks' cards more frequently.

When quantifying the revenues banks can see from such a solution, participating banks using PayLead's reward solution have seen average gains of 6€ per user per year, with an opt-in of 1 million users that could equate to a 6 million euro increase in revenue. Together with projected increases in user adoption and maturity seen in the payment marketing industry within Spain, the figure could climb north of 45 million euros within the next three years.

Establishing viable revenue models and opportunities with Open Banking

The two-pronged reward strategy is just one example of finding a pathway to viable revenue models with Open Banking integrations that are highly accessible for end clients and easy to adopt. With third-party providers developing suites of revenue-generating solutions, the path to profitability may be just around the corner, thanks to expected increases in adoption.

The centralization of banking data is another game-changing revenue opportunity third-party providers can present to financial institutions. Banks have historically struggled to leverage the wealth of data trapped within legacy systems.

Arturo Gonzalez Mac Dowell, CEO at Eurobits (now part of Tink) and Vice President of AEFI Spain, depicted the challenge of regrouping customer data, noting, “The series of data silos are preventing banks from attaining a holistic view of their clients.”

With the complete data picture, banks could put in place triggers alerting them to opportunities to propose personalized offers of banking products to clients at the opportune time. Thanks to third-party providers, tapping into this data could automate sales processes and open another door to support incumbent bank strategies.

Analysis from Accenture highlights the global wave set to come from third-party providers creating value along the entire value-chain for banks and financial super-apps. Data from the 20 largest economies representing 75% of global GDP suggests that there could be as much as $416 billion in revenues at play as Open Banking continues to mature. What portion of the forecasted figure will Spain and European players contribute may not be clear, but the opportunity for financial institutions to build agile partnerships with third-party providers to realize new revenues is sitting before them.

Interested in learning more about our white label loyalty solution, creating great customer experiences, and growing your business with PayLead? Schedule a call