Say ALO to the future of rewards

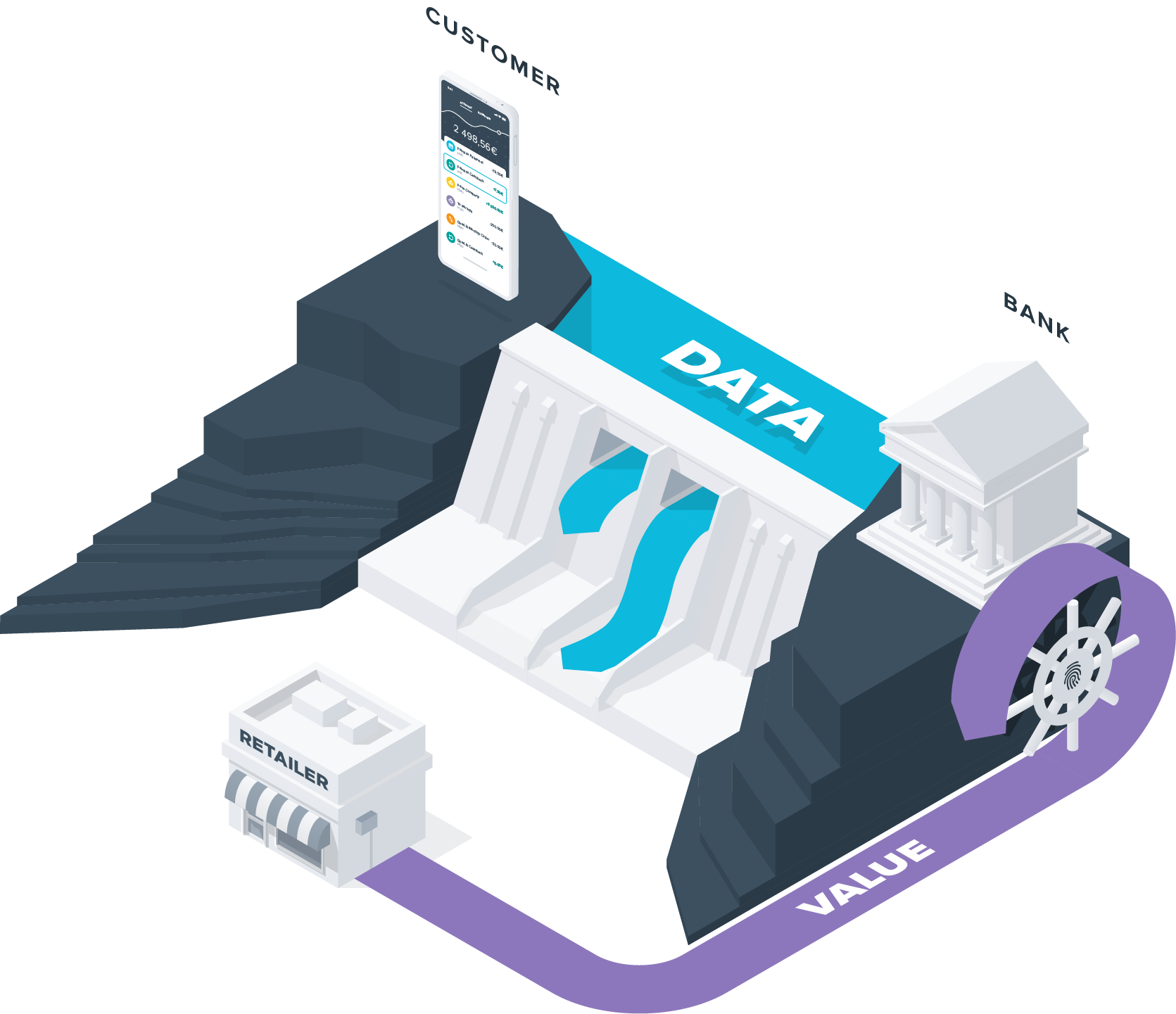

While payment providers continue to build infrastructure to generate customer insights from payment data, banks who gather a holistic view of all purchases, bank transfers and salary deposits still haven't fully harnessed or monetized their customers' data.

However, banks are now moving quickly and are looking to maximize banking data's value to personalize the banking experience across the board for every customer and fend off challenger banks. What isn't evident to many is the rush to leverage the power of payment data before the sleeping giant that is big tech finally crashes the party.

PSD2 and Open Banking as catalysts

With the introduction of the Payment Services Directive 2 (PSD2), banks must share their customers' data with Third-Party Providers (TPPs) when called upon, creating a flow of payment data that has marked the beginning of a new Open Banking era. The phenomenon is being embraced by market players and has seen the emergence of new features used to enhance the banking experience by allowing customers to manage their finances in one place. Whether it be aggregating bank accounts in a single interface, viewing recent transaction history across accounts, creating a budget, making forecasts or even providing a digital financial coach to optimize personal finances, the mission is clear, provide more value packaged in an unmatched user experience.

PSD2 facilitates this access to payment data and allows market participants to offer real value to clients with much-improved cashback rewards experiences. In France, where cashback hasn't fully taken off, the rewards scheme has recently gained traction and is being implemented at traditional banks like BNP and neo-bank challengers such as Aumax, who are adopting the feature to increase customer acquisition and retention. We've become accustomed to several traditional cashback methods, including offers from loyalty programs, vouchers sent by merchants, or cash rewards sent to your account following transactions made with a bank card. However, open banking's power now provides the necessary integrations to revamp the experience from the ground up.

From CLO to ALO®, and the introduction of "Payment Marketing" for banks and merchants.

Today the most widely used cashback program is the Card-Linked Offers (CLO) system that allows consumers to participate in promotions or earn cash when they use their bank cards at merchant partners. These card-linked rewards use payment data to provide customers with relevant offers in banking apps and ensure they are credited directly to their bank account. Widely used across Europe, This program has been implemented by numerous European banks and neo-banks, including Société Générale, Barclays, BBVA, Santander, N26, and Revolut.

These programs work fine for the moment. However, CLO programs face limits in understanding the customers' entire financial life as they only carry out analysis of transactions on the holder's bank card. Open banking is challenging this system with a new rewards' solution that is also associated with one's bank account, known as Account-Linked Offers (ALO®). These new programs include Card-Linked Offers but provide a better understanding of the customer's financial life by harnessing transaction data not only from their bank card, but also other aggregated linked accounts, and SEPA credit/debit transfers.

With ALO®, customers will have the ability to access tailor-made loyalty programs with hyper-relevant offers from their favourite merchants, thanks to the analysis of transactions made from an account level and not a single card. When purchasing from a merchant, participants will benefit from promotional or rewards offers sent directly to their account without the hassle of redeeming or exchanging rewards points. These new loyalty plans are plug & play and provide a high degree of flexibility for banks looking to craft a unique user experience. Banks can decide how to present and place the program in their application, create a branded consent page, rank offers based on purchase history, and categorize offers by type, location or reward rate. The entire experience is open to the bank's interpretation and gives them the freedom to provide an interface that their customers are familiar with.

In a highly competitive banking and consumer fintech environment, adapting quickly and creating smarter cashback offers will become a priority for those looking to capture an audience looking for a better overall experience. By leveraging the benefits of the holistic data banks have, the selection of personalized offers will only continue to match a customer's current needs better and give merchants a more precise target. Banks can also use this data to promote and upsell their offers.

Transactional data, a real gold mine, remains mostly unexploited, but its nascent and increasing usage marks a turning point that tech giants are paying close attention too. By exploiting this data and implementing Payment Marketing strategies, banks, FinTechs, and insurers can leverage the data they have collected before players like Apple and Google, who offer their digital wallets, make their presence felt. An ALO® program presents banking and personal finance players an opportunity to finally get a leg up by putting their data to use while proposing added value to their customers who can earn tangible cash rewards.

What are the benefits of an ALO® program?

ALO® program advantages for Banks, Neo banks, Fintechs and Insurers:

- Create recurring revenue by receiving a commission every time a client is rewarded from the program

- Improve the NPS score by creating tangible value for your clients with a personalized loyalty program.

- Maximize your credit and debit card usage by increasing card spend.

- Engage your less active customers and turn them into top-of-wallet users.

- Enrich customer profiles by giving an overview of events related to bank accounts, such as recent deposits.

ALO® program advantages for Merchants:

- Get a global view of user purchasing behaviour: including online and in-store purchases.

- Access to a unique audience of users from banking, insurance, and personal finance apps.

- Benefit from an all-in-one performance marketing platform using a CPA model.

- Leverage a personalized recommendation engine for consumers which analyses millions of transactional data points and ensures offers with a high probability of participation from consumers are sent to them.

Who owns the data, and how is it processed?

A few years ago, transactional data belonged to banks and card issuers. With the application of PSD2 in 2018, ownership of data has returned to end-users. Today, if a customer gives their consent, a fintech like PayLead can fetch the transaction data (anonymously), process the data, and distribute rewards accordingly. Some may ask how the data is collected, treated and used to reward consumers?

Using the example of PayLead and their Transaction HUB, the tool consolidates, cleans, and sorts transactions by gathering multiple data points from different sources thanks to PSD2 APIs and or scraping. Once found, the data needs to be formatted and made legible. Unfortunately, there is currently no standard for transaction data on the market, thus the need for a machine learning tool such as PayLead's Transaction HUB that transforms the data into a single standardized format. The HUB provides an end-to-end process that collects, sorts, cleanses, and enriches data to optimize its use in a rewards program.

Customizing loyalty programs

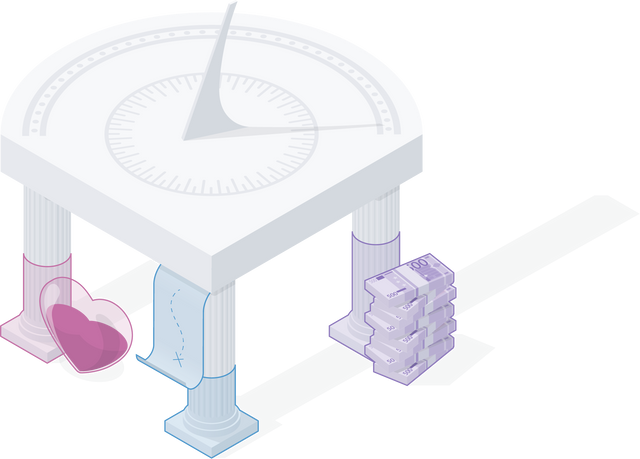

Consumers are no longer interested in mass advertising, and they want a tailored yet simplified user experience that presents relevant offers. Brands need to better understand customers' preferences and offer them the most relevant promotions to stay top of mind for consumers. Via a probability of conversion, these new loyalty (and cashback) programs can reliably define and promote offers currently relevant to a customer's financial life. But what are the pillars that calculate the probability of conversion?

- First Pillar: The geolocation score

This score is measured and determined for each customer. The first goal is to understand the purchasing preferences of customers, either in-store or online. If you are organizing an in-store program, you need to check that your targeted customers are close to the brand location. If you are creating an online program, you need to make sure that your clients have a genuine interest in online shopping.

- Second Pillar: The brand love score

Based on user consumption analysis, a recommendation system integrated into the rewards programs determines which brands your customers already prefer and predicts others they may have an interest in.

- Third Pillar: The generosity score

By focusing on the offers, the goal is to identify the intrinsic quality of the campaigns created by considering the value of the discount, the reward period, the date of publication, the brands, and the customers' existing interest.

These three pillars create a global conversion probability score that helps generate relevant campaigns. This global score continues to improve as new data is collected that will enrich the recommendation engine and create an independent and continuously improving machine.

The future of rewards is now

We are currently witnessing a considerable change in the cashback world. As innovation continues to progress, CLO programs will turn into ALO® programs to harness the holistic view of transactional data (payment cards, SEPA credit/debit transfers, account aggregation, etc.). ALO® programs will better understand the customers' financial life and breath new life into a Payment Marketing model that financial players, insurers, and merchants can leverage to offer personalized offers tailored to their customers. No matter how you flip the coin, both consumers, as well as banks and merchants, build stronger bonds with each other and see real value from a virtuous economic model that rewards all parties. Today, rewards have started to skyrocket, but it's a market just beginning to show its full potential.

Interested in learning more about our white label loyalty solution, creating great customer experiences, and growing your business with PayLead? Schedule a call