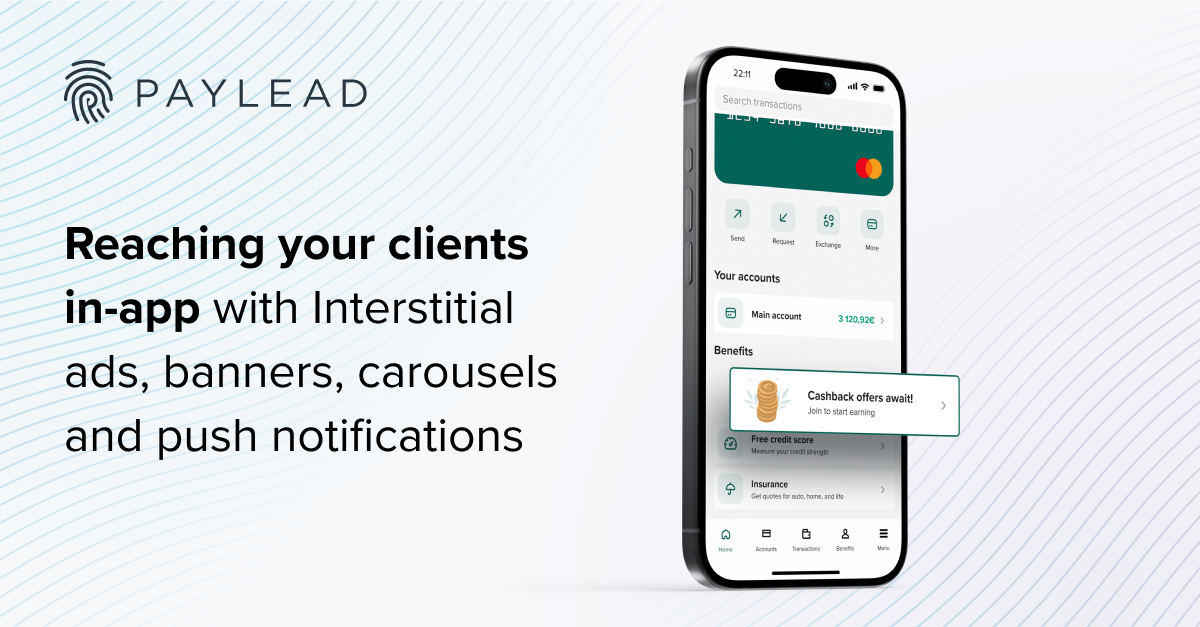

Utilizing your in-app channels: Interstitial ads, banners, carousels and push notifications

Your banking app is your primary channel of communication and acquisition tool. This is where your clients will follow the onboarding process and is thus the most direct path for users to join the program.

We highly recommend using all the communication tools available in your application, including interstitial ads, banner ads, and push notifications.

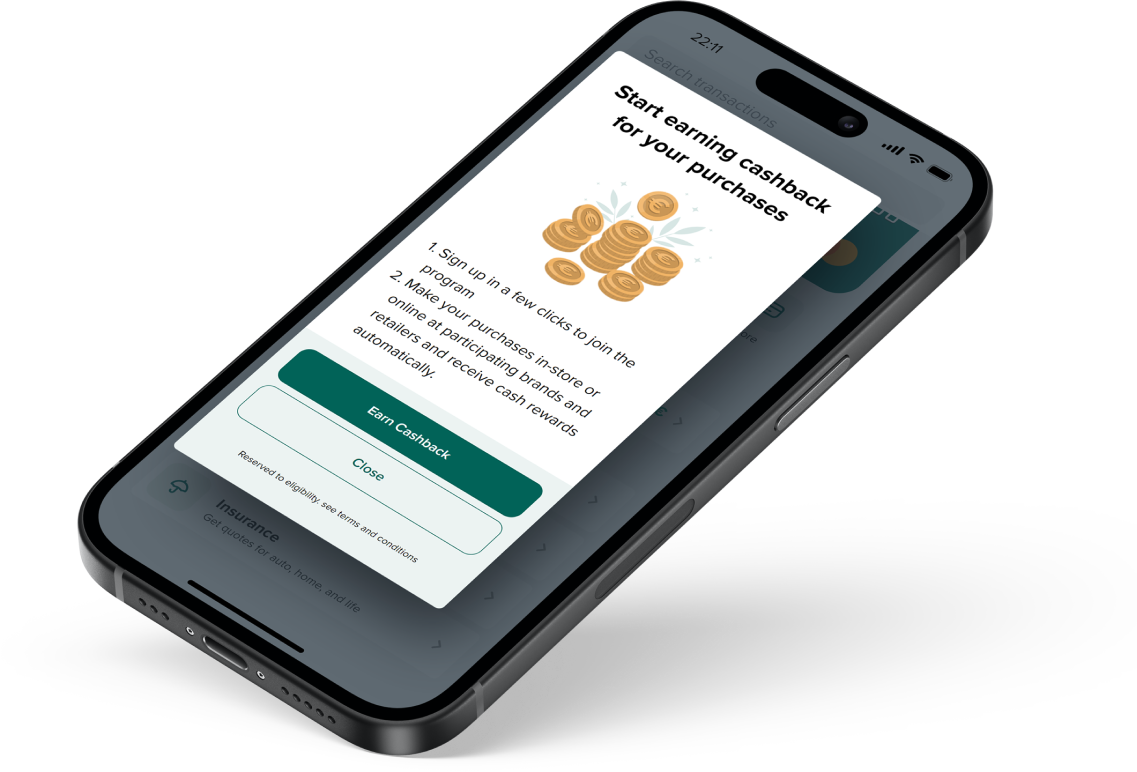

Interstitial

Within your banking app, including an interstitial ad that appears after logging in should be used at the launch and periodically afterward. Typically, interstitial ads cover 70% of the screen, providing a high-impact message and a CTA that fills 30% of the ad itself.

Among our partners who have deployed interstitial ads, they have reported an average click-through rate of 3.7%, which is roughly 1% higher than click rates on ads promoting all other products (2.6%). Our banking partners have registered 3 to 10 times the average daily opt-ins when deploying interstitial ads.

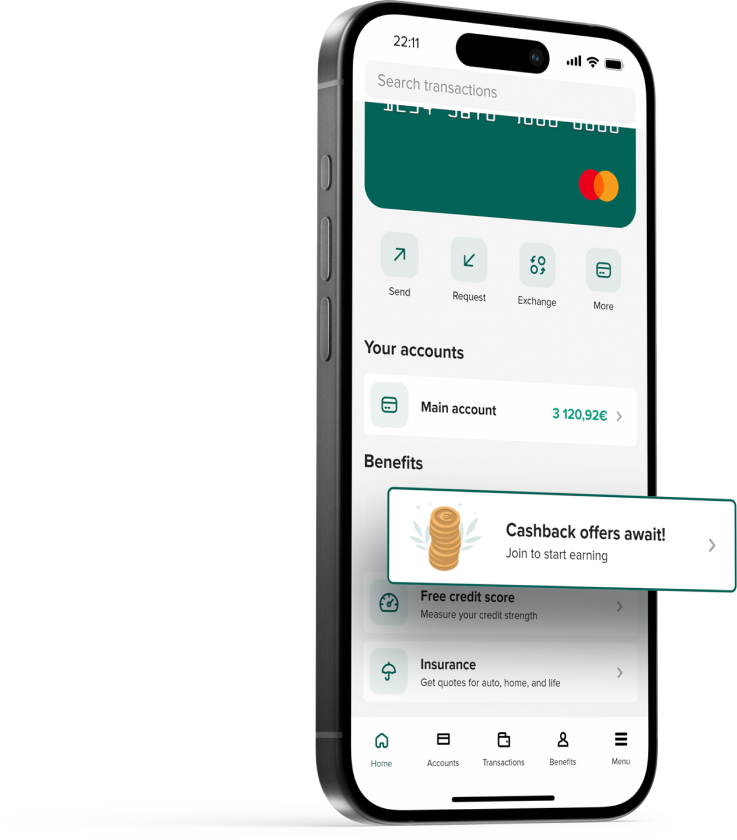

Banners and carousels

Most often located on the accounts and homepages of banking apps, banner ads fill valuable space in the user interface. When placed above or below valuable screen real estate, such as current accounts or transaction history, banner ads generate significant click-through rates. Together with our partners, we've documented a 28% click-through rate from these messages that sent users to the onboarding process. These ads have seen financial institutions in PayLead's network increase daily average opt-ins by 3x during an extended two-week period.

Banners are frequently part of a carousel of revolving banner ads showcasing various products. To maintain visibility, we recommend positioning the reward program in the first slide. Contrary to interstitial ads, we recommend keeping the slide promoting the program even after it has been seen, as banner ads do not prohibit users from continuing their journey through the application like interstitial ads.

With limited space, keeping your messaging short and impactful is critical for any banner ad. The highest-performing banners use direct calls to action that use the word "cashback" and highlight the key benefit for users: earning cash when they spend.

Nudging clients with push notifications

Push notifications give programs the rare ability to reach users directly outside the app. Like newsletters, they are a communication tool that reaches clients outside a financial institution's primary channels. This tool gives you the power to nudge your clients, bring them into your app, and straight into the discovery phase of onboarding.

We recommend sending push notifications to announce the program's launch. Remember that notifications afford you the least space to get your message across, so using short, concise, and impactful messaging is integral to getting users to click through.

For more on the best practices across different channels, make sure to read the other articles in the series or download the complete guide below :

- Using traditional media outlets and social media to inform new and existing clients about cashback rewards

- Leveraging email and newsletters for your cashback program

Get the best communication practices for the launch of your automatic cashback program

Learn how to plan your communications, generate a constant flow of opt-ins, and ensure lasting engagement

Download the guide