Preparing for a cookie-less world: the alternatives marketers are adopting to reach their goals

Chrome's expected removal of cookies made the media rounds again in January 2024, with 1% of users seeing third-party cookies crumble for good.

With that news, we look closer at other solutions marketers are employing, the importance of first-party data, and how PayLead's solution complements the cookie-less strategies of brands.

Cookies are slowly crumbling

While 1% doesn't seem like much, that's roughly 30 million users from a browser that 65% of the world uses, and by the end of the year, cookies will be gone for good. At what pace the other 99% will join the one percent is currently unknown.

Despite regular delays, Google looks set to stand its ground as the advertising industry sinks its teeth into Google's Privacy Sandbox, which should take hold by 2025 at the very latest.

What consequences will cookie deprecation have on advertising?

The end of third-party cookies will make customer profiling difficult. Advertising costs may rise, and effectiveness may decrease. Most tools used to measure website and advertisement performance rely on cookies, making it harder to prove attribution and measure campaign efficiency.

The end of cookies may also limit ad space for some time, allowing GAFA ad platforms and retail media outlets to increase pricing, which could lower the ROI of campaigns.

Google's Privacy Sandbox is finally set to take center stage

While Google has faced many challenges rolling out an alternative to cookies, most notably with the FLoC fingerprinting debacle which saw Google create the Topics API, their suite of tools to replace cookies has finally taken shape.

The Privacy Sandbox and its many APIs have been designed to reduce cross-site and cross-app tracking while serving users with relevant content and ads.

The APIs advertisers are focused on include:

- The Protected Audience API for remarketing and creating custom audiences without third-parties tracking user behavior across sites. Chrome will hold information about what users may be interested in to safeguard users' privacy instead of Adtechs. Chrome uses this data to build relevant audiences for advertisers based on interest groups for remarketing, while keeping users anonymous.

- The Topics API enables interest based advertising by analyzing the content that Chrome users interact with rather than the exact websites that users are visiting. Chrome then shares what they call “Topics” with adtechs who bid for impressions. The list of topics continues to grow but it begs the question of how specific they could possibly be and how well they correspond to ad creatives.

- Attribution Reporting, which focuses on creating event level reports that highlight clicks correlating to specific ads and ad views with conversions.

- The Private Aggregation API, which collects aggregate data from worklets (javascript that returns information back to the requestor) that have access to cross-site data to create reports.

What other alternatives are advertisers adopting?

Currently, 75 percent of marketers rely heavily on cookies, and 45 percent spend more than half their budgets on tools that depend on them, according to a study from Adobe.

However, the redistribution of marketing budgets is in full swing as marketers seek new solutions and identifiers to pick up where cookies left off and compensate for the expected dip in performance.

Advertisers will need to pair their first-party data with a combination of solutions, including newly developed IDs, Google's Privacy Sandbox, retail media networks, contextual tools, and transaction data, to continue reaching audiences effectively.

Finding alternative IDs

In response to the end of third-party cookies, ad tech companies have put forward various alternative identifiers that replicate the use of cookies without the privacy issue. Some of these include the Unified ID and SharedID, operated by Prebid, and RampID, to name a few.

There are many other initiatives, but they all fall into two categories, those being:

- Deterministic IDs, that require a personal identifier, such as an email that is hashed (anonymized with another value) to respect the privacy of users. This solution requires user consent from first-party audiences and is retrieved from the sign-in process of websites. The most significant disadvantage to deterministic IDs is that users spend most of their time online, not logged in.

- Probabalistic IDs are used to deliver ads without first-party data and rely on different factors such as IP address, device type, screen resolution, and operating system, among others, to determine who a user might be. While this may answer the scale issue of Deterministic IDs, it creates more room for data inconsistencies and makes it difficult to target audiences across multiple devices. Not to mention that these solutions may depend on fingerprinting, a practice that Mozilla, Apple, and Google frown upon, as users can be tracked without knowing.

As ad platforms experiment with various potential identifiers, the hope is that the market will eventually adopt a standard. For the moment, advertisers must make do with the current tools available to balance efficiency and privacy.

Building an audience with contextual advertising

Contextual advertising relies, as you would think, on a user's current context and uses AI and deep learning to consider multiple factors such as geolocation, imagery, and text in real time to place the most relevant ad.

As we bid adieu to cookies, contextual advertising gives advertisers a privacy-friendly option to retrieve relevant data without cookies. Large platforms are not waiting in the wings to adopt a contextual marketing approach. News recently broke that Amazon struck a deal with UK publisher Reach to obtain contextual first-party data from data collected across websites.

For more on contextual advertising, you can read this great article from Outbrain, and for more on the impact Custom AI may have on the solution, here's a good read from Digiday.

Retail media will be vital with the deprecation of third-party cookies

Retailers with large platforms may benefit most from the final farewell of cookies, as smaller brands look to redistribute budget and access platforms that collect first-party data and share it as second-party data.

What is second-party data? It's first-party data collected that a company shares or sells to trusted partners.

Fast-moving consumer goods (FMCG) retailers players like supermarkets, big box stores, and marketplaces have endless amounts of first-party data to quench the thirst of smaller brands looking to craft marketing strategies and purchase ad space on their platforms.

While retailers may have had this data for a substantial time, they finally realize its value. The unique ability to reach consumers at the point of sale by sending personalized ads and offers based on their interactions gives advertisers an incredibly effective tool that's taking up more space in marketing budgets.

BCG expects retail media to account for 25% of all digital media spending by 2026 and global revenues to reach $100 billion in the next five years.

Leveraging zero-party and first-party data to foster loyalty

Now that the "cookie apocalypse" is upon us, audience targeting will increasingly depend on zer0 and first-party data that gives brands insight into customers' demographics, purchase behavior, and interactions.

What's the difference? Zero-party data, refers to data customers willingly share with brands. First-party data is unsolicited data that is collected from users through company apps and websites.

What qualifies as zero and first-party data? Anything retrieved directly from your audience, such as:

- Demographics

- Transaction data

- Behavioral data

- Email and sign-up data

- Customer feedback

- Customer preferences

- Social media interactions

Creating loyalty programs that retrieve and use this data to personalize marketing across channels gives brands a means to drive every metric (conversions, engagement, interactions) and work towards building customer loyalty.

Relying on one's data rather than turning to walled gardens gives brands the insight to cater to their existing clients throughout the purchase journey. That's why operating loyalty programs presents a critical strategic initiative that allows brands to monetize data by driving engagement and sales with hyper-personalized offers within their own environment.

How PayLead maximizes loyalty for brands and retailers

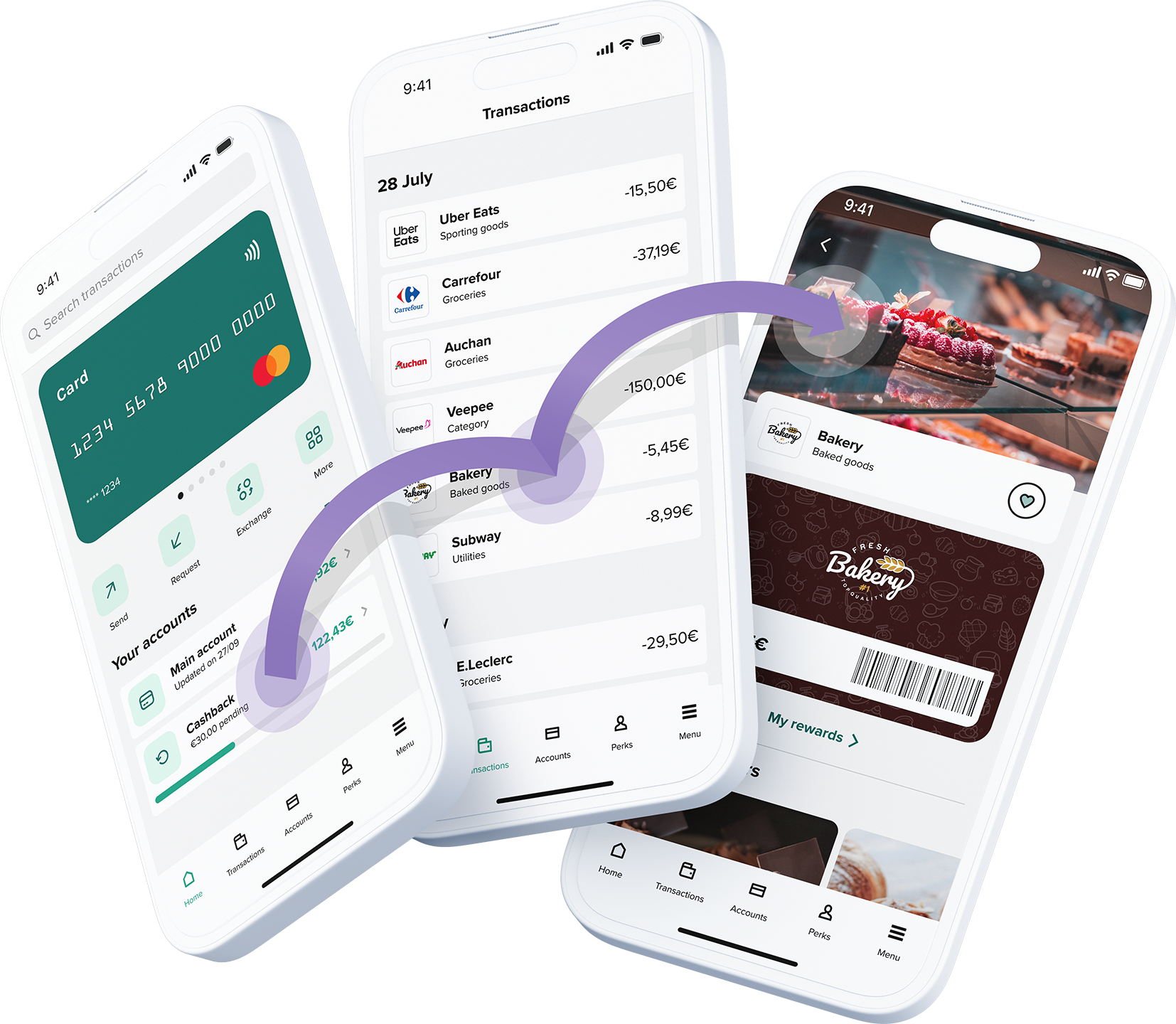

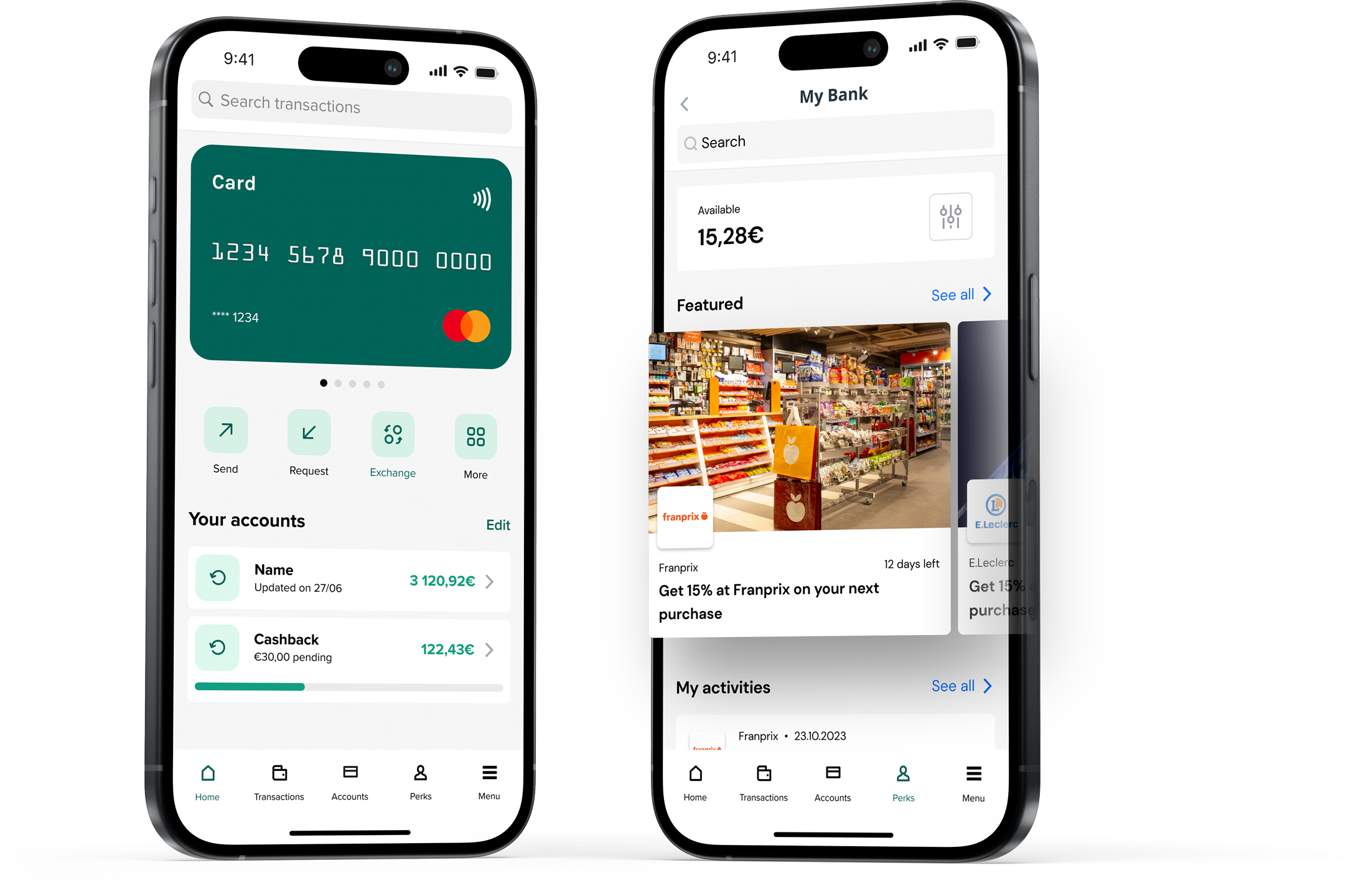

PayLead extends the reach of brands and retailers by creating synergies with banks to embed loyalty into the banking and purchase experiences of consumers across Europe.

We're developing a seamless method for retailers to acquire new loyalty program members and collect more first-party data in-store by linking their loyalty account to their bank card. This ensures that customers earn loyalty points immediately when paying with their bank card, without ever having to show a loyalty card.

How does it work? Cardholders are prompted to link their card when making a purchase and can link their account in less than a minute with their banks KYC data allowing to pre-fill sign-up forms. Once onboarded, customers can review their loyalty points in a dedicated brand corner within their banking-app and click through to the brand's app or website to shop exclusive offers.

With our Seamless Loyalty Card solution, PayLead is facilitating loyalty for brands and customers with a solution that rewards all parties involved. This unique experience ensures that retailers retrieve valuable first-party data, banks create engaging experiences for their customers, and most importantly, consumers receive monetary value for sharing their data by earning rewards and cashback.

How payment marketing is complementing media strategies

While most of the solutions presented above employ marketing based on intent and context, payment marketing uses customer purchase history to target new and existing audiences with card-linked offers.

Access to real-time, actionable data from consenting cardholders allows brands and retailers to segment audiences based on their purchase history from top-of-wallet bank cards. When cardholders are activated, they receive an automatic cashback reward for their purchase decision.

Payment marketing allows merchants to use purchase insights that uncover where, when, and how much consumers are spending. With this data, merchants craft strategies that go beyond acquisition, creating campaigns that reward customers for their loyalty while increasing average tickets, purchase frequency, and wallet share in their sector.

For a more detailed look into our solution, head over to our article going through the ins and outs of payment marketing.

PayLead is one the leading providers of payment marketing that not only reaches brand objectives but delivers tangible value to consumers at a time when inflation is eating at the pockets of people across Europe. For more about how we work with brands harnessing purchase insights to drive results make sure to check the related reading below.

Related reading:

- Payment marketing: What is it and how do I use it?

- How Le Slip Français continues to see a 7x return on investment with payment marketing

- Franprix & PayLead: Using Payment Marketing to increase brand loyalty